[ad_1]

- Solana value hit new 2022 and nine-month lows on Thursday.

- Sturdy shopping for stress in SOL after returning into the $30 worth space.

- Huge, multi-month highs in quantity.

Solana price has suffered the identical collapse the broader cryptocurrency market has skilled. After final week’s destruction of Terra’s LUNA, traders and merchants are taking a look at initiatives with integrity – a type of is Solana.

Solana value presents shopping for alternative that may return SOL to $75

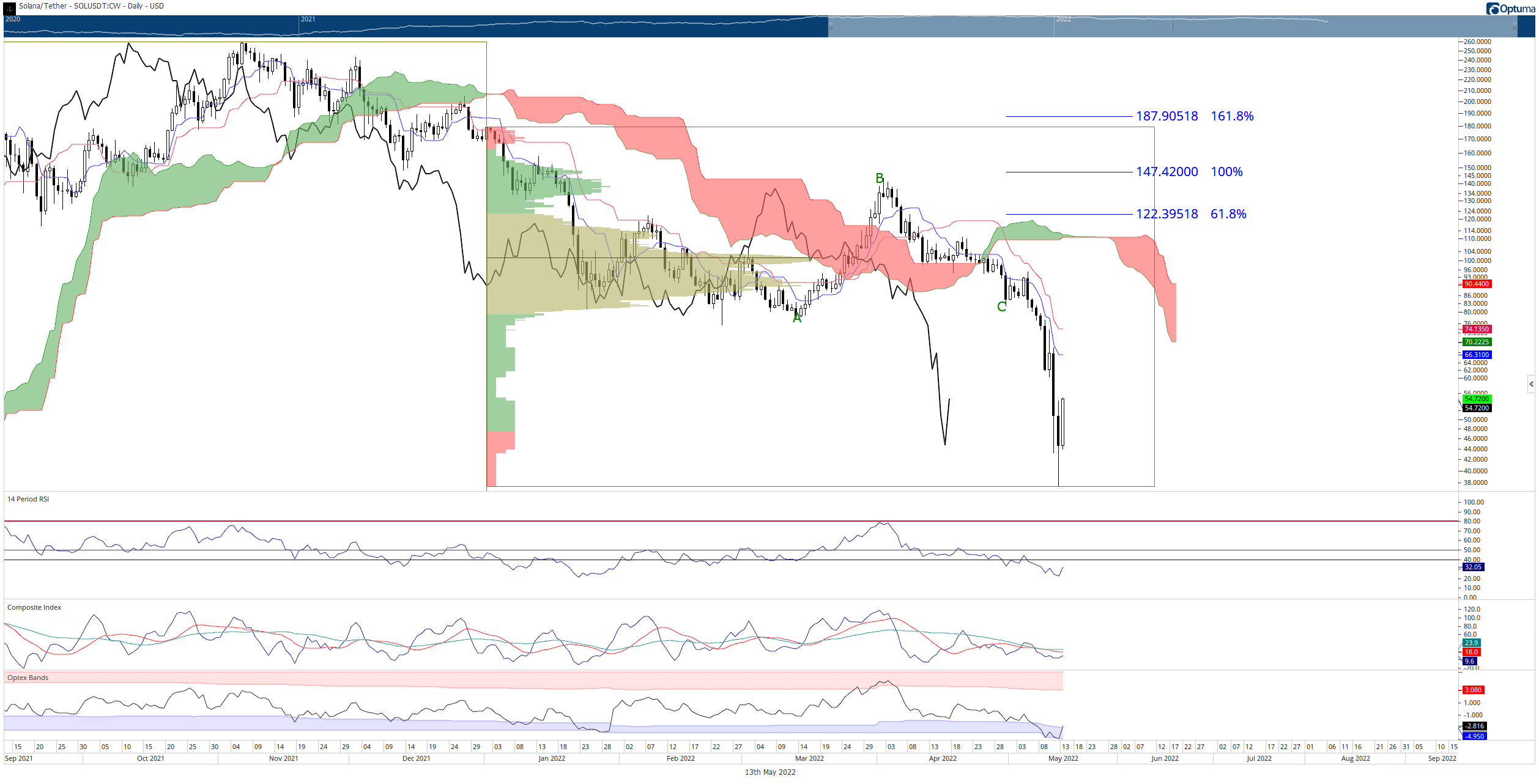

Solana price has moved effectively off the lows it skilled yesterday, transferring from a nine-month low of $35.63 to a present intraday excessive of $51.79 – practically a 51% achieve. The 88.2% Fibonacci retracement ($40.83), 78.6% ($50) Fibonacci retracement, and a excessive quantity node between $30 and $50 within the 2021 Quantity Profile have contributed to the bounce.

From the angle of Solana’s oscillators, excessive lows have been met with clear proof {that a} violent drive greater could also be proper across the nook. The Relative Energy Index hit lows not seen since January 2022. Within the Composite Index, common bullish divergence is at the moment current. Moreover, the %B’s slope reveals it could cross above 0.2, giving some sign merchants the situation wanted to go lengthy.

SOL/USDT Each day Ichimoku Kinko Hyo Chart

A day by day shut at or above the 78.6% Fibonacci retracement at $50 would doubtless verify that Solana price has hit its main swing low and will start one other rise greater. The primary main resistance zone above $50 is a resistance cluster close to the essential $75 degree: the 61.8% Fibonacci retracement ($73) and the day by day Kijun-Sen ($75).

Draw back dangers stay a priority however are more and more much less extreme in dimension and scope. Nonetheless, a day by day shut under $40 may point out an excellent additional and steeper push down in the direction of the subsequent excessive quantity node within the 2021 Quantity Profile at $18.

[ad_2]

Source link