[ad_1]

Avi Rozen

Produced with Ryan Wilday and Avi Gilburt

2022 has been a difficult 12 months for crypto buyers. The previous a number of months have had all of the hallmarks of a bear market given the entire extremely adverse developments all through the crypto area with a number of main bankruptcies in exchanges happening. Most not too long ago, and maybe the biggest (so far) was the demise of FTX (FTT-USD).

And whereas our bigger extra instant bullish thesis in Bitcoin (BTC-USD) has actually lowered in confidence as a result of extended break under $24k, Ethereum (ETH-USD) has extra carefully maintained adherence to bigger diploma expectations laid out this spring. Let’s evaluation:

From April twenty fifth article: Ethereum: A Technical Approach To The Next Year:

“That entails substantial draw back left on this correction however those that are ready with money can be clever to see this as a very good risk-to-reward shopping for alternative, supplied that these buyers are ready for the famous chance of volatility.”

Worth was buying and selling round $2,950 on the time of writing, and forecasted a transfer all the way down to the $1,200-$1,700 area as a shopping for alternative.

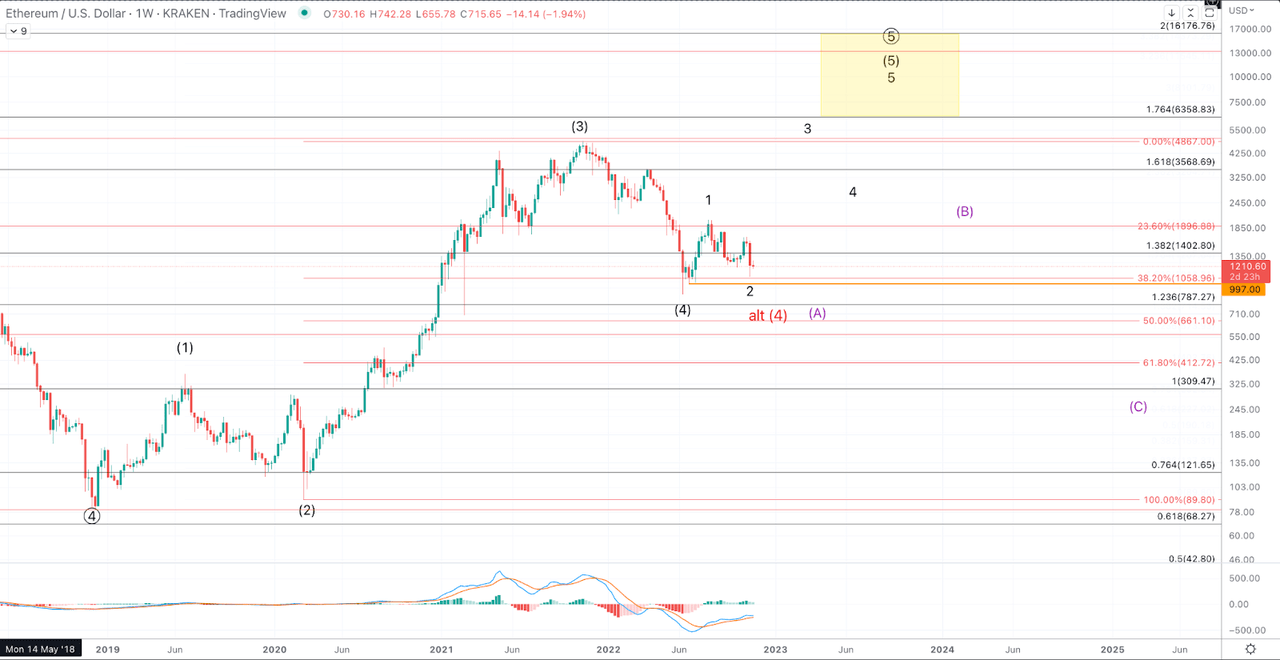

That mentioned, when the article was written, our expectations for this pullback had been that it could be a wave 4 inside a bigger wave (3). Contemplating the June low noticed worth break properly under $1,200, roughly $880 throughout exchanges, now we have now moved in direction of contemplating the next diploma pullback in ETH. That’s, this pullback is being thought-about a wave (4) slightly than a 4 of (3).

The place does that put us in a bigger context?

When the April article was written, it was famous that worth had shaped 3 waves up from the 2018 low however that wave (3) had not but accomplished. Once more, as a result of depth of this pullback, the percentages have strongly shifted to the all-time highs having accomplished the wave (3).

All that to say, we nonetheless have simply 3 waves up from the 2018 low in an in any other case impulsive construction, which thus strongly suggests there’s yet another excessive nonetheless to come back. As long as worth is holding assist for a potential (4), this thesis is unbroken. Bigger diploma assist for (4) is $787-$1,058, and thus far now we have a considerable bounce from that area. Moreover, ought to worth print decrease lows beneath these struck in June, I might enable for a check of the $660 area, however any significant break under that can go away us with a dependable prospect for the next excessive in wave (5). In different phrases, a significant or sustained break beneath $660 would probably sprint our expectations for the wave (5) larger.

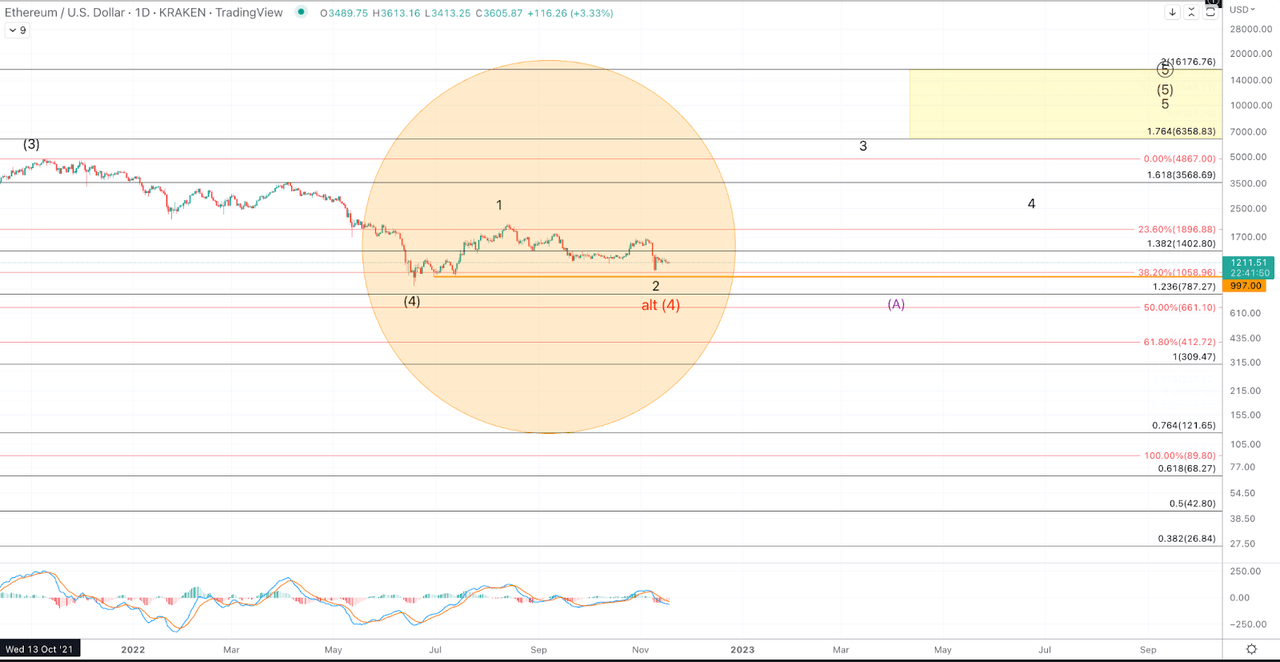

In accord with the bigger diploma bullish expectations, worth shaped a micro 5 wave rally from the June lows, offering the primary potential indication of a low having been struck for wave (4). The following retrace has develop into fairly deep, and as of writing this text, it’s moderately threatening a retest of the June lows. On the smaller diploma, as long as worth stays over $995-$1k, expectations are for upside comply with by means of. Ought to worth break $995 resoundingly, it’s fairly probably that the June low shall be examined and certain damaged.

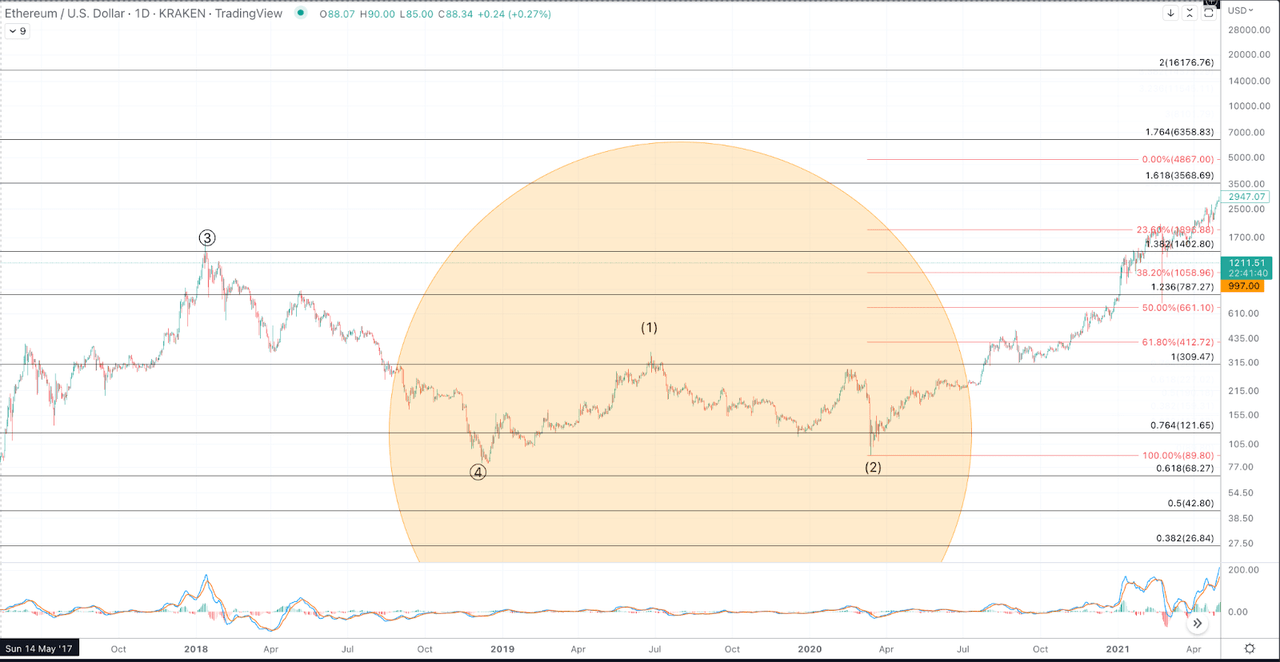

Please word the fractal similarity (See charts under, specifically the circled sections), albeit at totally different scales to the transfer off the December 2018 low into the June 2019 excessive and subsequent retrace. Each the rallies and declines present very related wave construction in addition to the depth of the wave (2) / 2. The March 2020 low equally challenged the thesis as as to if Ethereum would keep a viable (1)-(2) from the 2018 low.

What’s wanted to extra confidently set up the bullish thesis?

Worth wants an impulsive rally again above the late October excessive for starters. 5 waves up, first exceeding $1,680, after which $2,030 (the August 2022 excessive) can be a really optimistic improvement in direction of bulls emphatically taking management.

The subsequent step can be for the worth sample to take care of micro helps alongside the best way and breakout above $3k. At the moment, if now we have a low in place for wave 2, the 1.0-1.236 extension is available in at $2,465-$3,005. If ETH goes to show it’s headed to new highs, this area clearly will have to be retaken. That mentioned, even in a really bullish situation, it’s probably that this area would reject worth upon the primary check from under. As soon as worth takes out the August excessive, the related assist shall be roughly $1,750-$1,800. It’s obligatory for that area to comprise any declines from above $2,030 to take care of a assured bullish perspective.

Given the depth of this pullback into the 2022 low, our upside expectations have considerably dampened. The minimal upside goal – assuming situations are met for holding wave (4) assist – is $6,350. That mentioned, cryptos tend (typically) to increase of their wave 5s and so I cannot rule out a visit as much as $16k.

Lastly, contemplating the bounce from the November lows is slightly anemic so far, we might be remiss to not be looking out for potential decrease lows.

Within the coming days, if worth takes out $1k and heads to $660, even when that area holds, our confidence in worth recovering to new all-time highs shall be considerably shaken. A bounce is predicted from that area however at the moment, I cannot rule out the chance that such a bounce, from $600-$660 is only a corrective (B) earlier than a way more vital draw back develops as proven in purple.

ETH-USD Weekly 2018-Current

Jason Appel (Crypto Waves)

ETH-USD 2018-2019 (1)-(2) Fractal

Jason Appel (Crypto Waves)

ETH-USD June 2022-November 2022 1-2 Fractal

Jason Appel (Crypto Waves)

[ad_2]

Source link