2017 is in full swing at Grayscale the place one bitcoin is nearly over $9,000, a worth stage first reached to a large applause of memes about 5 years in the past.

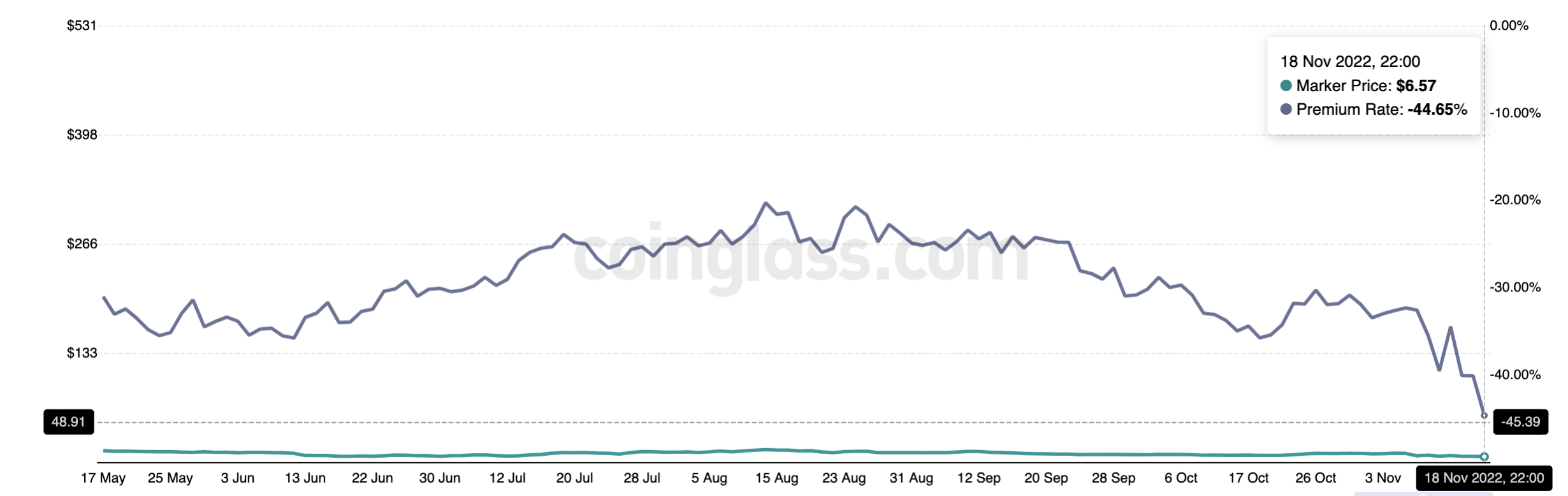

Ethereum is just not faring significantly better, with it going for $660 at Grayscale’s Ethereum Belief (ETHE), a worth 45% under the worldwide market charge of $1,200.

That makes this the worst 12 months ever for the Grayscale trusts since they first launched in 2013, and sentiment has gotten worse nonetheless after Genesis paused withdrawals.

They’re a Digital Forex Group (DCG) subsidiary, as is Grayscale. Genesis had a $170 million publicity to FTX, however contemplating the huge holdings of DCG, you’d suppose they’re small potatoes.

Barry Silbert, its CEO, might himself maybe cowl that $170 million as he’s value $2 billion, however the truth they haven’t been ready to take action far could nicely point out DCG is working a tighter ship than it would seem.

Development of their merchandise has stalled and even contracted with the bear starting to chunk whereas sharks go hopping from venture to venture to see what may fall.

“As a consequence of safety issues, we don’t make such on-chain pockets info and affirmation info publicly out there by means of a cryptographic Proof-of-Reserve, or different superior cryptographic accounting process,” Grayscale mentioned.

That courted some ridicule as a result of public key cryptography means you’ll be able to safely share your public key, besides this isn’t Grayscale’s coverage however Coinbase’s, their custodian.

Coinbase has all the time refused to publish their public addresses. Not like many different exchanges which have one or a couple of large chilly wallets, Coinbase chops up theirs in tons of addresses with balances of 5,000 to 10,000 BTC.

A couple of years in the past it may need been tough to seek out them, however these days we’d be stunned if some on-chain analysts didn’t have them neatly mapped out in all their positive glory.

If the general public actually needed such Proof of Reserves, subsequently, they’ll go draw good charts of all addresses with balances of precisely 5,000 or 10,000 and label them as Coinbase.

There’s about a minimum of 100 of them, actually 50, with it unclear this ‘safety concern’ actually nonetheless holds, however this has all the time been Coinbase’s coverage of safety by means of obscurity.

Nobody is critically speculating that GBTC doesn’t have the 633,000 bitcoins nevertheless, though proof for such issues is healthier than ‘belief us,’ with the hypothesis being extra on whether or not they’ll must dissolve the belief.

A belief as you may know is a automobile from the Chancellery courtroom the place the proprietor in possession has obligations in the direction of the authorized proprietor. Grayscale on this case has obligations in the direction of the GBTC shareholders who’re the precise homeowners of the cash despite the fact that Grayscale possesses them.

Grayscale subsequently has to behave of their greatest curiosity, with the query being whether or not dissolving the belief can be of their greatest curiosity particularly when there’s the choice of suing SEC, as Grayscale has, to grant the ETF conversion for the belief.

Arguably that ETF conversion is healthier for these shareholders, and since Grayscale receives a 2% annual administration payment, they in all probability received’t dissolve successfully their enterprise except they completely must.

Compartmentalizing Genesis Capital nevertheless has turned out to be much more tough than they may have initially thought.

DCG tried to color Genesis Capital as a totally completely different, remoted factor on the market which has nothing to do with these different issues, but out there the pause of withdrawals at Genesis is reflecting on DCG, on Grayscale and on all their different merchandise as a result of they’re the homeowners or share the identical homeowners.

As well as it’s fairly unclear why they’ve allowed this low cost to develop to such an excessive stage.

It isn’t solely new because the premium was excessive too and Grayscale tried to do one thing about it by shopping for some $750 million worth of GBTC final 12 months, however the low cost has solely gotten worse since.

The corporate is subsequently in some difficulties as its lending unit suspends regular operations, with it to be seen whether or not sharks will hop from right here, or circle.