[ad_1]

The FTX-induced bloodshed price Solana probably the most because it plunged 55% in per week falling from $38 to $12. SOL was among the many most laborious hit after information broke out that Alameda holds $1.2 billion price of the tokens. Rumors swirled round social media claiming that Alameda plans to dump SOL to keep away from insolvency.

Nonetheless, none of that occurred however the injury to Solana was already executed. Buyers bought their SOL holdings inflicting a domino impact of panic sell-offs final week. The dip made buyers afraid of taking an entry place as customers are at present unable to foretell when it may backside out.

Additionally Learn: Ethereum Likely Headed towards $600 Levels, Here’s Why

Will Solana Reclaim The $30 Ranges?

Through the bear markets, slipping south is simple however heading north turns into a herculean job. For Solana to leap from its present ranges of $14 to $30, it must double in value by growing 110%. The correction put up the FTX fiasco and the continuing harsh bear market situations may stunt SOL’s value in 2022.

Since Could, Solana has been repeatedly rejected at $50 and is unable to push its weight above the resistance ranges. Its value noticed a decline in August falling beneath $40 and confronted rejection each time it got here nearer to those ranges for 3 months straight.

Additionally Learn: How Long Will Bitcoin Take to Recover From the FTX Fiasco?

Solana has repeatedly did not claw above its resistance ranges in 2022 and the following two months may stay the identical. SOL must breach the $20 mark first to think about transferring above the $30 degree. For that, it wants to leap one other 50% from right here, which appears to be a tough job on this ongoing bear market.

Due to this fact, Solana reaching its earlier ranges of $30 by the tip of December 2022 appears to be a problem.

Additionally Learn: Cardano Prediction: When Will ADA Recover From Its Slump?

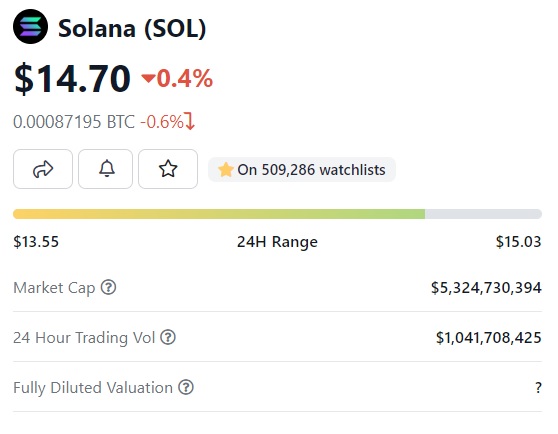

At press time, Solana was buying and selling at $14.70 and is down 0.4% within the 24 hours day commerce. It’s down 94.6% from its all-time excessive of $259, which it reached in November final 12 months.

[ad_2]

Source link