[ad_1]

luza studios

Just a few months in the past, I wrote a cautious article on HIVE Blockchain Applied sciences Ltd. (NASDAQ:HIVE), highlighting some pink flags within the firm’s This fall/2022 earnings report. Particularly, I used to be fearful that HIVE’s Ethereum (ETH-USD) mining tools might turn out to be out of date with a pending transition to a “Proof-of-Stake” (“POS”) system. I used to be additionally fearful about HIVE’s mining margins, as HIVE had been mining at unfavorable gross margins in This fall/2022. Since my article, HIVE has declined over 30%.

After reviewing the newest figures from HIVE’s month-to-month manufacturing reviews and cryptocurrency costs, I proceed to suggest buyers keep away. At present crypto costs, HIVE seems to be mining at unfavorable gross mining margins, i.e. not even protecting the price of electrical energy. The lack of Ethereum mining has dealt a heavy blow to HIVE’s operations. Mixed with elevated Bitcoin (BTC-USD) mining problem, HIVE’s month-to-month manufacturing of BTC has declined 40% from August to October regardless of including 7% in ASICs.

Ethereum Merged And Its Influence On HIVE

After I wrote my preliminary article, there was nonetheless fairly a little bit of doubt in regards to the pending Ethereum conversion to POS. The truth is, HIVE itself had been downplaying the timeline and affect, with the corporate making enjoyable of the lengthy delayed transition of their Q3/F22 presentation (Determine 1).

Determine 1 – HIVE downplayed Ethereum merge (HIVE Q3/F22 Presentation)

Sadly for HIVE and different Ethereum miners that derived revenues from Proof-of-Work on the Ethereum community, the Ethereum community successfully merged to a POS system on September 15, 2022. The merge made Ethereum mining tools out of date, with many GPUs now selling below MSRP and listing costs.

As a reminder, HIVE had 6.49 Terahash of Ethereum mining capability on the finish of August, which produced 3,010 ETH (equal to 228.4 BTC, in response to HIVE). HIVE additionally mined 290.4 BTC in August, utilizing their devoted ASIC miners, so in whole, the corporate produced 518.8 BTC equal.

In response to the Ethereum Merge, HIVE commented that the corporate could be pivoting its enterprise to concentrate on Bitcoin, together with the digital treasury belongings (i.e. it might not HODL ETH). Because the merge, HIVE revenues from GPU mining had been dramatically diminished, from ~7 BTC/d to 1.6 BTC/d, because the GPUs had been transformed to mine alt-coins.

In September, the transition month, HIVE mined 268.9 BTC from ASIC mining, 1,394 ETH (equiv. to 111.6 BTC), and 15.8 BTC from GPU mining of alt-coins for a complete of 396.3 BTC.

In October, the first month of BTC solely mining, HIVE mined 262 BTC from ASIC mining and 45 BTC from GPU mining for a complete of 307 BTC.

So because of the Ethereum merge, HIVE’s BTC equal mining manufacturing declined by over 40%, from 519 BTC in August to 307 BTC in October.

Bitcoin Issue Proceed To Climb; HIVE Operating On A Treadmill

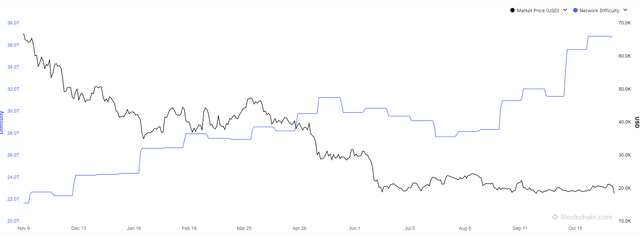

Additional compounding HIVE’s Ethereum drawback was the truth that the issue to mine Bitcoin continued to climb, just lately pushing new all-time highs regardless of the autumn in Bitcoin costs (Determine 2).

Determine 2 – Bitcoin problem vs. worth (blockchain.com)

So at the same time as HIVE continued so as to add ASIC mining rigs, with its ASIC hashrate rising 7% from 2.23 Exahash in August to 2.38 Exahash in October, the variety of BTC it mined from ASIC mining really declined 10% from 290 BTC in August to 262 in October.

What Is HIVE’s Margin Now?

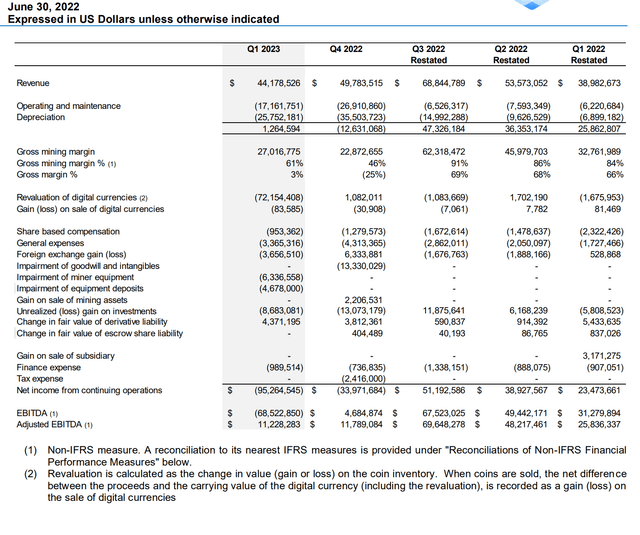

Revisiting my concern on HIVE’s margin profile, admittedly, I used to be too bearish in my prior article once I identified HIVE was mining at unfavorable gross margin in This fall/F22, as various one-off bills had inflated working and upkeep bills. Within the first quarter results reported in August, Gross Mining Margin expanded QoQ to 61%, as working and upkeep prices normalized considerably to $17.2 million. Nonetheless, I used to be directionally right, as HIVE’s Gross Margin, which included depreciation of mining tools, was solely 3% in Q1/F23 (Determine 3).

Determine 3 – HIVE working abstract (HIVE Q1/F23 MD&A)

Are Gross Mining Margins Now Zero?

Trying ahead, we’re at an fascinating juncture. On November ninth, Bitcoin crashed to ~$17,000 as one of many seemingly ‘untouchables’ of the trade, FTX, was forced to seek a bailout from its main rival, Binance.

What’s fascinating is that, if we assume HIVE’s Q1/F23’s working and upkeep prices are the norm, that works out to a each day mining price of ~$190k ($17.2 million over 91 days). From the October manufacturing replace, we additionally know that:

As of November 2, HIVE is producing a median of over 9.5 Bitcoin per day from ASIC and GPU manufacturing, comprised of over 8 Bitcoin per day from our ASIC fleet and over 1 Bitcoin per day from our GPU fleet.

Even when we’re beneficiant and assume HIVE produces 10 BTC per day, at present bitcoin costs, HIVE is just producing $170,000 / day (10 BTC occasions $17,000 / BTC) in revenues.

Subsequently, it is extremely doable that HIVE is at present mining at a unfavorable gross mining margin. This could imply mining revenues can not even cowl the electrical energy prices.

Dangers To Bearish View

Clearly, the largest threat to my bearish view goes to be cryptocurrency costs. In August, following my final article, HIVE briefly topped $7/share as threat belongings had a summertime rally. Nonetheless, I feel over the long term, HIVE can not escape from the truth that at present crypto costs, its mining gear could also be mainly burning power and cash because it mines at unfavorable gross mining margins.

Abstract

In abstract, I proceed to be cautious of HIVE. At present crypto costs, HIVE seems to be mining at unfavorable gross mining margins. The lack of Ethereum mining has dealt a heavy blow to HIVE’s operations. Mixed with elevated BTC problem, HIVE’s month-to-month manufacturing of BTC has declined 40% from August to October regardless of including 7% in ASICs.

[ad_2]

Source link