[ad_1]

- Ethereum Merge behind us, a part of Bitcoin dominance has commenced and altcoins have suffered a decline up to now week.

- The present market cycle is marked by lengthy accumulation and lengthy consolidation phases, analysts take into account this worse than a bear market.

- Ethereum value is on a steep decline, analysts have set a draw back goal of $1,277 for the altcoin within the ongoing massacre.

Profitable completion of the Merge has paved the way in which for Ethereum’s 18% dominance. Apparently, Ethereum, XRP and Cardano, amongst different altcoins, are exhibiting indicators of weak spot of their value traits. Analysts consider it’s the finish of altcoin season and the start of Bitcoin’s dominance but once more.

Additionally learn: Bitcoin price sink or swim: Largest BTC exchange inflow worries investors

Ethereum value continues decline regardless of profitable Merge

Ethereum Merge is efficiently behind us and the crypto neighborhood has turned its eyes to the Cardano Vasil exhausting fork. The hype surrounding the Ethereum Merge has died down, ETH value is on a steep decline. Analysts have set a bearish goal of $1,250 for Ethereum’s value.

Merchants ought to concentrate on the bearish indicators in Ethereum’s value development. Although dealer sentiment was bullish forward of the Merge, the decline in ETH value has fueled a bearish sentiment amongst Ethereum holders.

Ethereum value decline put up Merge

Analysts on the YouTube channel Bleeding Crypto recognized Ethereum’s lack of assist at $1,362 as a key bearish sign for the altcoin. Analysts have anticipated one other drop down in Ethereum value, to assist on the $1277.30 stage.

ETH-USDT Perpetual Contract 12-hour chart

Analysts at FXStreet are bearish on the Ethereum value development. For key value ranges, examine the video under:

Bitcoin vs. high 50 altcoins

Analysts at crypto intelligence platform IntoTheCryptoverse argue that Bitcoin’s dominance is gaining floor. Ethereum Merge fueled a bullish sentiment amongst holders, pushing ETH dominance to 18%. Bitcoin subsequently must outperform Ethereum and the highest 50 cryptocurrencies.

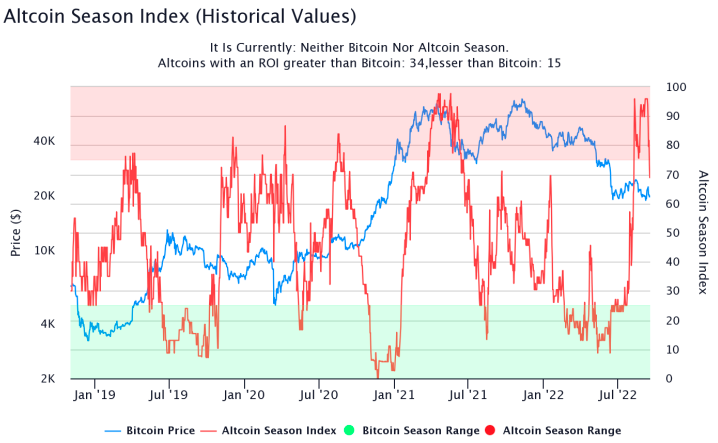

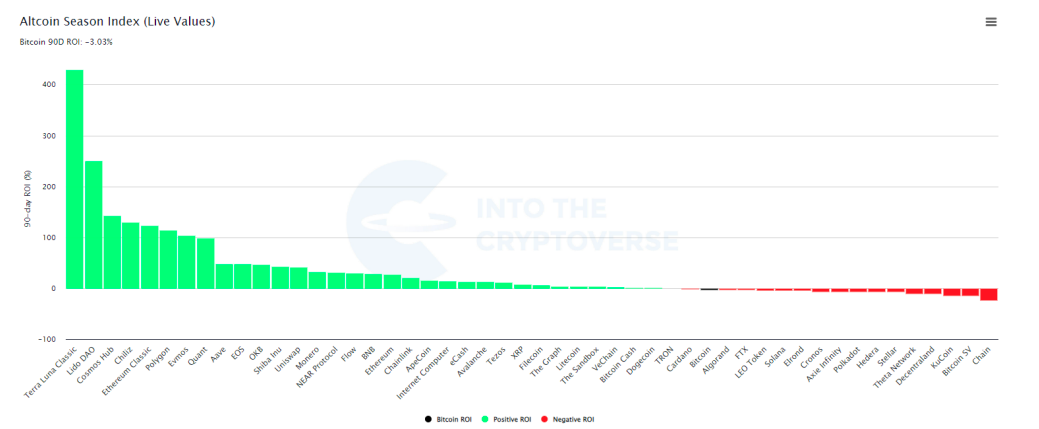

Altcoin season index is taken into account an indicator of altcoin value development reversal and what to anticipate from cryptocurrencies into 50. The index at present reads 69, and this suggests it’s not Altcoin season. Analysts argue it’s a bear market within the ongoing cycle and Bitcoin dominance is prone to overtake altcoins. When lower than 25% altcoins have a 90-day ROI higher than Bitcoin, it’s Bitcoin season. Due to this fact, analysts consider Bitcoin season is about to begin.

Altcoin Season Index

Ethereum, XRP and Cardano value traits present indicators of weak spot

After month-long altseason, a interval during which 75% of the altcoins have a higher 90-day ROI than Bitcoin, altcoins have witnessed a massacre. Altcoins in high 30, Ethereum, XRP and Cardano have witnessed double-digit losses in a single day. Whereas there may be nonetheless a excessive variety of altcoins with a 90-day ROI higher than 100% and Luna Basic is the very best performer, liquidity has began flowing into Bitcoin.

IntoTheCryptoverse’s report on altcoins reveals a change in influx of capital. The decline under the purple area within the Altseason Index reveals extra altcoins have began bleeding towards Bitcoin once more. Analysts have recognized a weak spot within the Ethereum, XRP and Cardano value development.

Altcoin Season Index

[ad_2]

Source link