[ad_1]

JuSun

The article beneath appears to be like at the place the notorious Mt. Gox chapter stands in addition to the renewed rumors that its Rehabilitation Plan may negatively influence Bitcoin (BTC-USD) and Bitcoin Money (BCH-USD) costs. Along with the previous power of a easy HODL technique, the Mt. Gox dialogue additionally highlights two takeaways for digital asset investments extra broadly:

- The excessive relative worth of a blockchain’s majority chosen fork

- Sound custody preparations embrace chilly storage and proof of reserves audits

However earlier than shifting to Mt. Gox, it’s helpful to understand that macroeconomic components at the moment overshadow any basic evaluation. Tuesday’s launch of the August CPI once more proved rates of interest and rate of interest coverage expectations are the bulk shorter-term drivers within the digital asset area. Following the discharge, Bitcoin costs instantly tanked by $1300, shut to six%. And even with The Merge impending, Ethereum (ETH-USD) dropped over 7%.

The headline month-over-month inflation quantity got here in a cool .1% with the important thing gasoline element down 10.6% for the month. Progress in meals costs remained extremely elevated at .7%, although the speed has moderated relative to the 13.5% annualized. Nonetheless, core costs shocked to the excessive aspect. All gadgets much less meals and vitality rose .6% in August. This was twice the July charge, which many market members had regarded to as a optimistic pivot from the extremes of the second quarter. Among the many core readings, shelter and medical care companies stood out for his or her excessive and rising charge of enhance.

The upshot, solely essentially the most optimistic of Fed watchers now stay hopeful of a .5% enhance at subsequent week’s FOMC assembly. And as of Wednesday, CME futures pointed to a 70% chance of a .75% elevate within the federal funds charge. Apparently, the opposite 30% chance is for a historic full level enhance. Importantly, larger charge expectations proceed to batter the rate of interest delicate tech sector and risk-on property.

Mt. Gox Collapse and Rehabilitation

Mt. Gox was a digital asset market launched in 2010. By the point of its collapse in February of 2014 it was accountable for an estimated 70% of the Bitcoin commerce worldwide. That month the corporate revealed it had misplaced about 750,000 of its clients’ Bitcoins price on the time between $400 and $500 million. It’s believed these cash have been stolen through hacks over a time period, probably in 2011 and 2012.

Since 2014 there have been difficult chapter and rehabilitation proceedings and a number of lawsuits regarding Mt. Gox’s property. The addressable property, that are managed by a trustee, now major consists of 100,000 to 150,000 Bitcoins, yen price about $500 million, and a comparatively small quantity of Bitcoin Money.

In fact over this era, Bitcoin costs have gone from a number of hundred {dollars} a coin to just about $20,000. And although it will get difficult, it now appears to be like probably nearly all of the victims, regardless of the substantial hacks, can be compensated 5-6 instances the worth of their Bitcoin investments across the level of Mt. Gox’s withdrawal freeze and chapter submitting. For perspective, this is able to be tipple the return of the Nasdaq Composite over the identical interval.

Bitcoin Dump And Droop Hypothesis

Thursday, September fifteenth was an vital date for the Mt. Gox rehabilitation in that’s began a interval of no claims transfers within the leadup to a primary base fee for many collectors. This deadline had the de facto impact to restrict the power to make or replace claims. And it represents a milestone within the timeline towards payouts.

Every milestone within the course of has introduced hypothesis that the eventual payouts would result in a big scale sale of Bitcoins by the trustee to lift funds or by collectors, as soon as Bitcoins are returned to them. These speculations stay outstanding within the media. For reference and simplified, a spherical quantity for the whole worth of those Bitcoins is $3 billion and collectors can take money or a mixture of money and cash.

Take into account the next current headlines:

Mt. Gox Repayment Coming in ‘Due Course’ as Bitcoin Dump Fears Spook Market, decrypt.co, September 1, 2022

Mt. Gox Creditors Inch Closer to Repayment as Bitcoin Dump Looms, bloomberg.com, July 7, 2022

Mt. Gox Bitcoin black swan event: BTC price facing $3bn of sell pressure as refunds begin, capital.com, August 23, 2022

and these headlines from a previous rehabilitation milestone:

Bitcoin investors shake with fear as Mt. Gox prepares to dump 141,000 BTC, fxstreet.com, 11/17/2021

Bitcoin heads for worst week in months as Mt Gox payouts loom, reuters.com, 11/18/2021

The headlines above are hyperbolic FUD. Bitcoin’s per day, respectable buying and selling quantity is extremely contested. However Forbes lately estimated it at $128 billion and revered researchers and market members place it at $25-$35 billion per day. Recall from above, the whole worth of Mt. Gox’s Bitcoins is about $3 billion, a significant however small share of a single day’s commerce.

However importantly, the place is not going to be liquidated without delay or in its entirety. Collectors can take the biggest share of the rehabilitation payout in sort and a considerable variety of these collectors will probably maintain a portion of cash somewhat than instantly liquidate. Additional, a significant share of the cash are unclaimed or have unresolved claims or lawsuits pending. It’s difficult, however a number of repayments are additionally anticipated to be additional cut up into completely different tranches for various selections. The current trustee communication defined simply one in all these cases.

If repayments can be made with money obtained from the sale of cryptocurrency by the Rehabilitation Trustee, a compensation date completely different from the compensation dates of different allowed rehabilitation claims could also be set with the permission of the Court docket because the sale of the cryptocurrency could take a while.

Information on Prohibition of Assignment, etc. of Rehabilitation Claims, mtgox.com, August 31, 2022

The dreaded dump highlighted within the headlines above probably by no means materializes or can ever be observed in precise buying and selling quantity.

Mt. Gox: Classes For Crypto Investing

In August of 2017, effectively after the collapse of Mt. Gox, variations of opinion within the Bitcoin group led the blockchain to fork to 2 branches, Bitcoin and Bitcoin Money. Mt. Gox was a holder earlier than and through this outstanding fork and subsequently has cash on each chains. Right now, Mt. Gox’s Bitcoin Money is price $17 million, a comparatively low quantity when in comparison with the Bitcoin holdings mentioned above.

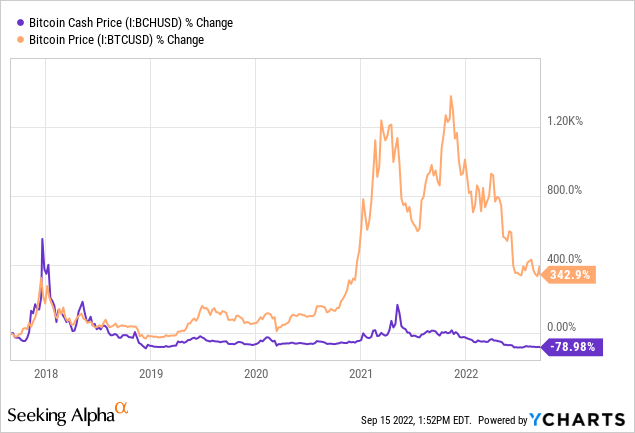

The chart above reveals the % change in worth of Bitcoin and Bitcoin Money since their forking. Apparently, the slower, extra vitality intensive Bitcoin is mostly thought to have gained out over Bitcoin Money as a result of it was perceived to be safer. Put in a different way, Bitcoin gained the branding battle.

Recognizing there has usually been a fork “winner” and “loser” over time is vital. Now we have seen one thing related although technically completely different with Ethereum and Ethereum Basic (ETC-USD) up to now. And crypto area buyers could face different choice factors within the coming months from this week’s merge on the Ethereum platform.

Past what one would possibly name the principle, new proof-of-stake Ethereum chain, there’ll probably be one or two extra branches to realize continued curiosity within the weeks following The Merge. Particularly, current months have seen plans to proceed a proof-of-work chain considerably like Ethereum Basic. In fact the preliminary valuation of those chains will dictate how they truthful in comparison with Ethereum over time. However as with Mt. Gox’s Bitcoin Money cash, market notion will probably play the important thing function within the valuation longer-term. On this case, Ethereum has the biggest assist of many of the influential builders together with Vitalik Buterin, in addition to the backing of assorted sector establishments. So Ethereum ought to considerably respect relative to its different forks over time.

The opposite apparent lesson from Mt. Gox is that sound custody preparations embrace chilly storage and high quality audits. It’s believed the hacks took the cash from the Mt. Gox sizzling pockets and that an trade auditor was sarcastically one in all numerous weak factors.

Bitcoin’s worth is derived from its decentralized, permissionless and clear ledger that operates in a trustless atmosphere. Digital asset marketplaces and different third celebration intermediaries current a complication to proudly owning and storing Bitcoin as they’re extra opaque, require belief and are a degree of weak point from a decentralized and permissioned perspective.

Whether or not collaborating by means of a digital asset market place or buying an trade traded product, look to the custody preparations close to storage and audits. As a place to begin for due diligence take into account Kraken’s proof of reserves audits and Coinbase’s (COIN) vault.

Takeaway and Bitcoin Ranking

The Mt. Gox rehabilitation demonstrates a easy Bitcoin HODL technique proved extremely profitable over the previous eight years. That is regardless of the present crypto chilly snap and depressed costs.

Nonetheless entrenched vitality and meals worth development together with a now cussed core inflation are regularly driving the Fed into extra giant charge hikes. This strain continues to depress the rate of interest delicate tech sector and risk-on property.

I’ve been improper this yr on the stickiness of inflation and stunned by the willingness of the Fed to react forcefully and repeatedly. That being stated, there are some causes to imagine a Fed pivot to smaller-sized hikes is approaching. Taking my dovish Fed outlook, alongside the substantial second quarter correction and the truth that Bitcoin is a longer-term maintain, I’m sustaining my purchase score right here.

[ad_2]

Source link