[ad_1]

That is an opinion editorial by Ali Chehrehsaz, a mechanical engineer with 16 years of expertise within the power trade.

This text will define how amassing photo voltaic power and storing it will probably present a strong dynamic for bitcoin mining operations by outlining that:

- Hybrid energy vegetation that pair electrical era, particularly photo voltaic, with batteries are rising quickly

- Bitcoin mining can be integrated in these vegetation alongside batteries, for a similar causes

- Incorporating bitcoin mining in addition to batteries requires correct sizing of deployed property, and likewise splitting power between batteries, mining and the grid in a manner that optimizes income

- The trail ahead won’t be technically or commercially easy, however the alternative is huge

Hybrid Energy Vegetation

There’s a new breed of energy plant on the rise: batteries are being co-located with wind, photo voltaic photovoltaic (“PV”), fossil fuels, and so on. to create what are known as “hybrid power plants.” Amongst these hybrid energy vegetation, solar-plus-battery vegetation are the fastest-growing phase.

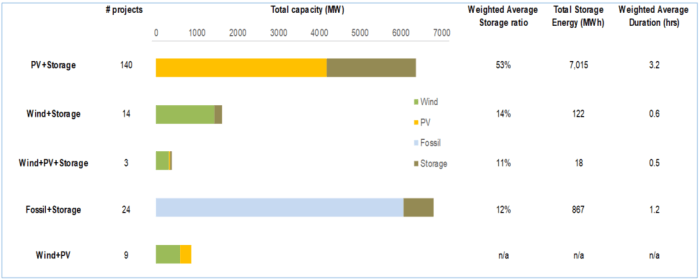

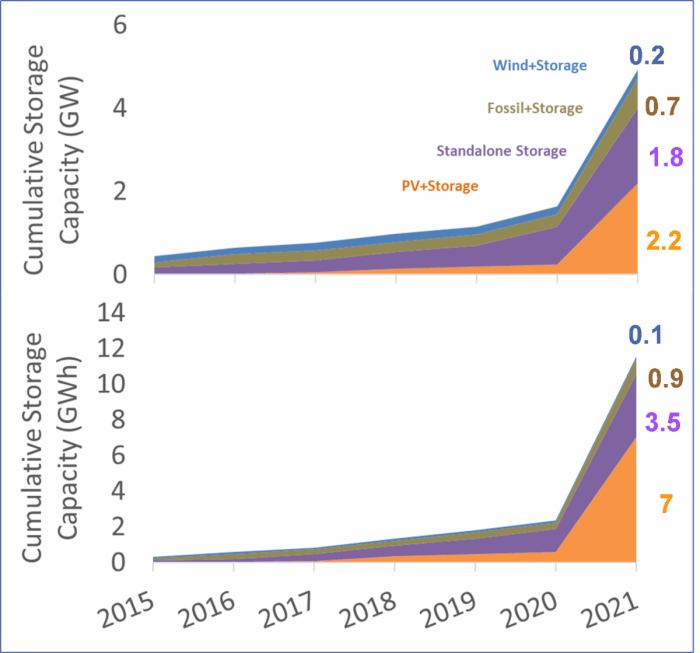

Lawrence Berkeley Nationwide Labs (LBNL) just lately revealed findings in a briefing titled “2021 Was A Big Year For Hybrid Power Plants — Especially PV+Storage.” Within the article, it talked about: “Among the many operational generator+storage hybrids, PV+storage dominates by way of plant quantity (140), storage capability (2.2 GW [gigawatts]/7.0 GWh [gigawatt hours]), storage:generator capability ratio (53%), and storage period (3.2 hours). ”

The briefing goes on to state that: “Final yr was a breakout yr for PV+storage hybrids particularly: 67 of the 74 hybrids added in 2021 have been PV+storage. By the tip of 2021, there was extra GW of battery capability working in PV+storage hybrids (2.2 GW) than as standalone storage vegetation (1.8 GW). A lot of the battery capability added in hybrid type in 2021 was a battery retrofit to a pre-existing PV plant.”

This final level is noteworthy, and we’ll come again to debate it later.

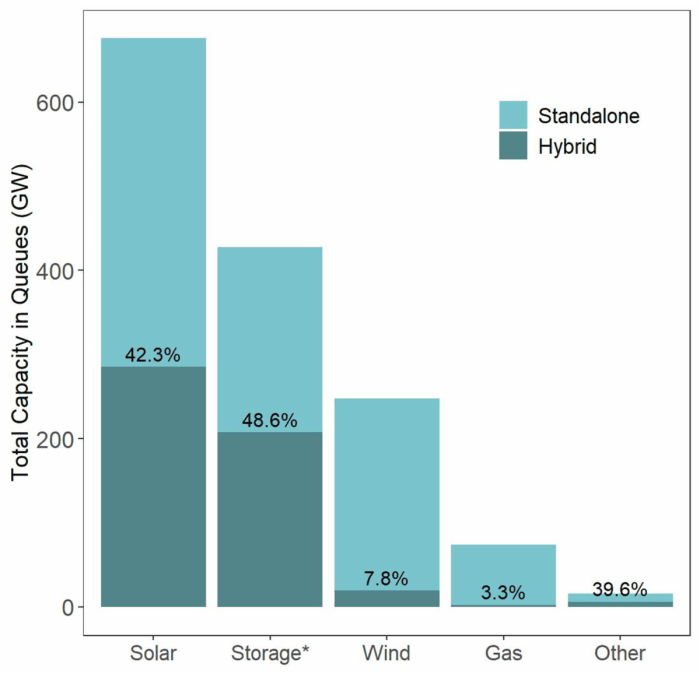

This pattern is constant and, because the article factors out, there have been greater than 670 GW of photo voltaic vegetation within the interconnection queues within the U.S. as of the tip of 2021.

Prisoners Of Time And Geography

Why are batteries being added to photo voltaic vegetation at such a fast price? There are two elements at play: deflation within the worth out there for photo voltaic power and the ever-increasing competitiveness throughout the photo voltaic trade.

Drawback One: Photo voltaic Worth Deflation

What’s photo voltaic worth deflation? The LBNL briefing offers a touch: “…[PV+storage] may be discovered all through a lot of the nation… although the most important such vegetation are in California and the West…” In a phrase: geography.

Solar energy in places like California, Nevada and Arizona is affected by an anti-network impact. The anti-network impact of photo voltaic happens in a market when penetration of photo voltaic in a location reaches a market-specific tipping level, after which the addition of recent photo voltaic capability reduces the profit (i.e., worth of photo voltaic era) for all photo voltaic vegetation in that market. In its 2021 “Utility Scale Solar” report, LNBL demonstrates this downside in additional element.

As photo voltaic penetration on a grid will increase, the worth that solar energy can seize decreases. This leads us to a different trace: time. The hours throughout which any given photo voltaic generator can produce electrical energy are, by definition, the identical hours that each different close by photo voltaic generator can produce electrical energy, which find yourself turning into the hours for which the market is oversupplied and costs are decrease.

That is why renewables are, in a manner, prisoners of time and geography. See the instance of California outlined by LNBL: At 22% penetration, solar energy can solely seize 75% of the worth of era with a baseload 24/7 energy profile. The issue is already seen in different markets at penetrations as little as 5%.

All markets are heading on this route. Homeowners of current or deliberate photo voltaic initiatives want to search out methods to hedge this danger and diversify their income streams.

Drawback Two: Excessive Competitors

The opposite issue is the success of photo voltaic, creating a particularly aggressive trade that’s now difficult additional progress.

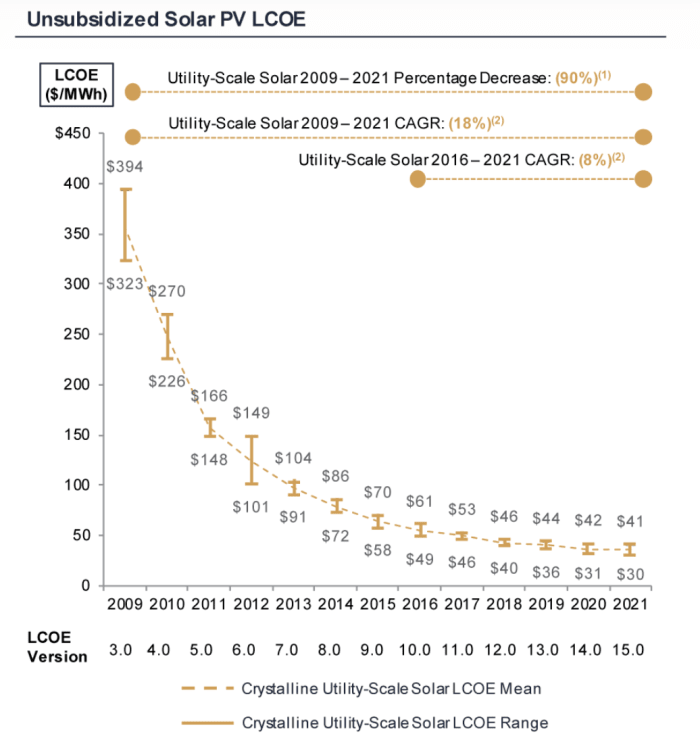

The photo voltaic trade began a lot later than different energy era industries and has needed to catch as much as earn its share of the facility era combine. The trade has been utilizing the levelized price of power (LCOE) metric to check its prices to coal, pure fuel and different era sources.

Solar became the lowest LCOE form of generation in the last decade and this has been driving the unbelievable progress of photo voltaic capability. However the competitors with different era sources continues throughout the trade itself, making a race to the underside which is eroding the returns for buyers in photo voltaic. The next chart is from an article by Lazard titled “Levelized Cost Of Energy, Levelized Cost Of Storage, And Levelized Cost Of Hydrogen” which reveals the fast drop in photo voltaic levelized price of electrical energy:

A continued discount in photo voltaic LCOE interprets right into a downward trajectory of revenues from photo voltaic vegetation. As such, buyers in photo voltaic are in search of methods to extend earnings throughout the confines of the facility market. Batteries are one such know-how that gives a path to greater revenues by means of arbitrage, demand response and ancillary providers.

The Roadmap For Bitcoin Miners

What’s the alternative for bitcoin miners? The best way that storage has dovetailed neatly into the photo voltaic worth stack offers a helpful roadmap for bitcoin miners to observe. Bitcoin mining also can present related alternatives for photo voltaic vegetation to entry greater earnings by working as a versatile useful resource for the grid.

However as a result of batteries have a hard and fast storage capability and supply a short-term power arbitrage alternative towards the native energy grid, ultimately, even a battery should take the native grid market costs. Bitcoin mining has no storage restrict (permitting long-term arbitrage) and may present arbitrage wherever on the globe (extra on that matter: “Bitcoin Is The First Global Market For Electricity”).

The pairing of bitcoin mining and photo voltaic is straightforward in precept however making the physics and finance work in observe is just not straightforward. To create accretive returns, Bitcoin miners must precisely dimension their deployments when co-locating with photo voltaic and battery hybrid vegetation. The co-location technique requires an understanding and prediction of the quantity of electrical energy manufacturing from the photo voltaic plant and the related worth of every unit of power produced by the plant. This have to be completed on each a long-term and a short-term (close to real-time) foundation, to assist design/funding and operations. Along with the probabilistic manufacturing quantity of photo voltaic, figuring out the worth of power at every interval have to be understood (e.g., five-minute interval); e.g., worth can range broadly and at instances can attain $0 per kilowatt hour (kWh) resulting from curtailments.

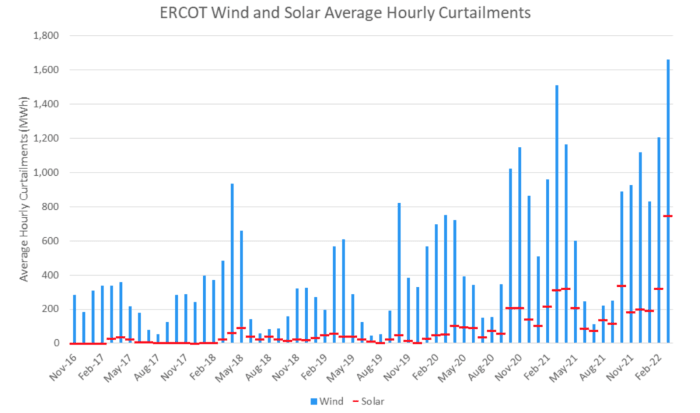

A facet word on wind and photo voltaic curtailments: Beneath is a chart from BTU Analytics exhibiting that wind and photo voltaic curtailments are increasing as extra intermittent renewables are deployed on the Electrical Reliability Council of Texas (ERCOT) grid. Essentially the most impacted wind and photo voltaic vegetation noticed 29% and 21% (respectively) of their whole annual era curtailed in 2021 to 2022!

Co-optimization for integrating bitcoin mining is a problem price fixing for miners given the rise of photo voltaic and battery hybrid vegetation within the combine of recent era sources. This pattern is prone to develop at an exponential price.

In abstract, rising deflation in worth and rise in competitors of photo voltaic have incentivized the pairing of batteries with current photo voltaic vegetation. Now there’s a new incentive that can speed up the expansion of battery paired hybrid vegetation.

What we now have seen to this point has taken place throughout the pre–Inflation Reduction Act (IRA) era. The IRA newly permits for a 30% investment tax credit (ITC) incentive for standalone batteries over the following ten years which can enhance the redevelopment of current photo voltaic vegetation to turn out to be hybrid vegetation.

As talked about earlier, battery retrofit to current photo voltaic vegetation is an rising phase. This phase will develop even sooner over the following decade with the brand new ITC incentive. The brand new incentive plus the funding in U.S.-based manufacturing of photo voltaic and batteries is poised to make the U.S. the main nation in photo voltaic and storage energy vegetation. Bitcoin miners have an enormous alternative to faucet into one of the quickly rising types of power era by determining the physics and finance of co-locating with photo voltaic and storage energy vegetation.

It is a visitor publish by Ali Chehrehsaz. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link