[ad_1]

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Bitcoin and Ethereum are presently standing nonetheless on a flat, shifting walkway at an airport, whereas others stroll quicker on the adjoining non-automated flooring. Possibly they’re sure to remain grounded for some time.

Ah properly, suppose we must be no less than grateful they, and the crypto market at massive, aren’t utterly capitulating once more. For now. That stated, there are many bearish headwinds about.

However what else is new? A good bit, however, er, let’s speak about a few these potential bearish headwinds.

Mt. Gox fears floor… actually, although?

There was a little little bit of concern resurfacing right here and there a few attainable impending Mt. Gox-related dump, however is that truly warranted? Mt. Gox, when you didn’t know, was a Japanese-based crypto alternate that misplaced about 850,000 Bitcoins in an alleged hack in 2014.

It has been reported that the Mt. Gox victims, its collectors, will this month start to obtain again a number of the stolen property, making a concern this might induce an extra crypto-market dumpathon.

Truth is, although, of these 850,000 Bitcoins, solely 140k of them have been recovered, which IF all collectors had been to promote, would solely symbolize about 8% of Bitcoin’s every day gross sales quantity. A drop within the orangey, peer-to-peer digital ocean, actually. And the opposite factor is, these collectors have the choice to obtain their funds again immediately in money as properly.

Sentiment might nonetheless contribute to driving crypto costs decrease based mostly on this occasion, after all. And talking of crypto sentiment, it’s really tumbled once more after a spurt of positivity just a few days in the past.

The US greenback rising, yeah… that’s not so good for crypto

Whether or not it’s ethically sound to “root” for a slide of the US greenback slide or not, the very fact is, a pumping buck has largely been a fairly bleak sign for dangerous property such because the magic web cash that’s crypto.

The US Greenback Index (DXY) had simply these days appeared prefer it’d run out of steam and was due for an prolonged southbound vacation. However, because the chart in presently very bearish US crypto analyst Justin Bennett’s tweet beneath exhibits, it’s really simply damaged some fairly vital resistance.

If it does rocket as much as the extent he’s speaking about within the subsequent few months, then crypto’s crappy 2022 may nonetheless have a methods to play out. The operative phrase being “if”, after all.

As ever, it’ll all largely hinge on the Fed. Current minutes from its final FOMC assembly, in July, indicated interest-rate climbing will proceed for the forseeable… however the stage of climbing might begin to lower – no less than from 75bps to 50, for instance.

As we mentioned yesterday, although, the 2022 bulls aren’t defeated simply but. And it’s nonetheless considerably comforting to notice that even essentially the most bearish in crypto tend to imagine within the stuff, or on the very least Bitcoin, long run.

Individuals like Director of Macro for funding agency Constancy Jurrien Timmer, as an example, who reckons a US$23k BTC is reasonable as chips.

Eye on digital currencies: If you happen to imagine in Bitcoin’s adoption-curve thesis (i.e. that the community will proceed to increase according to earlier S-curves), then it is affordable to view Bitcoin as low cost at these ranges. 🧵 pic.twitter.com/hEpuQTBmpG

— Jurrien Timmer (@TimmerFidelity) August 17, 2022

Time for some value motion…

Prime 10 overview

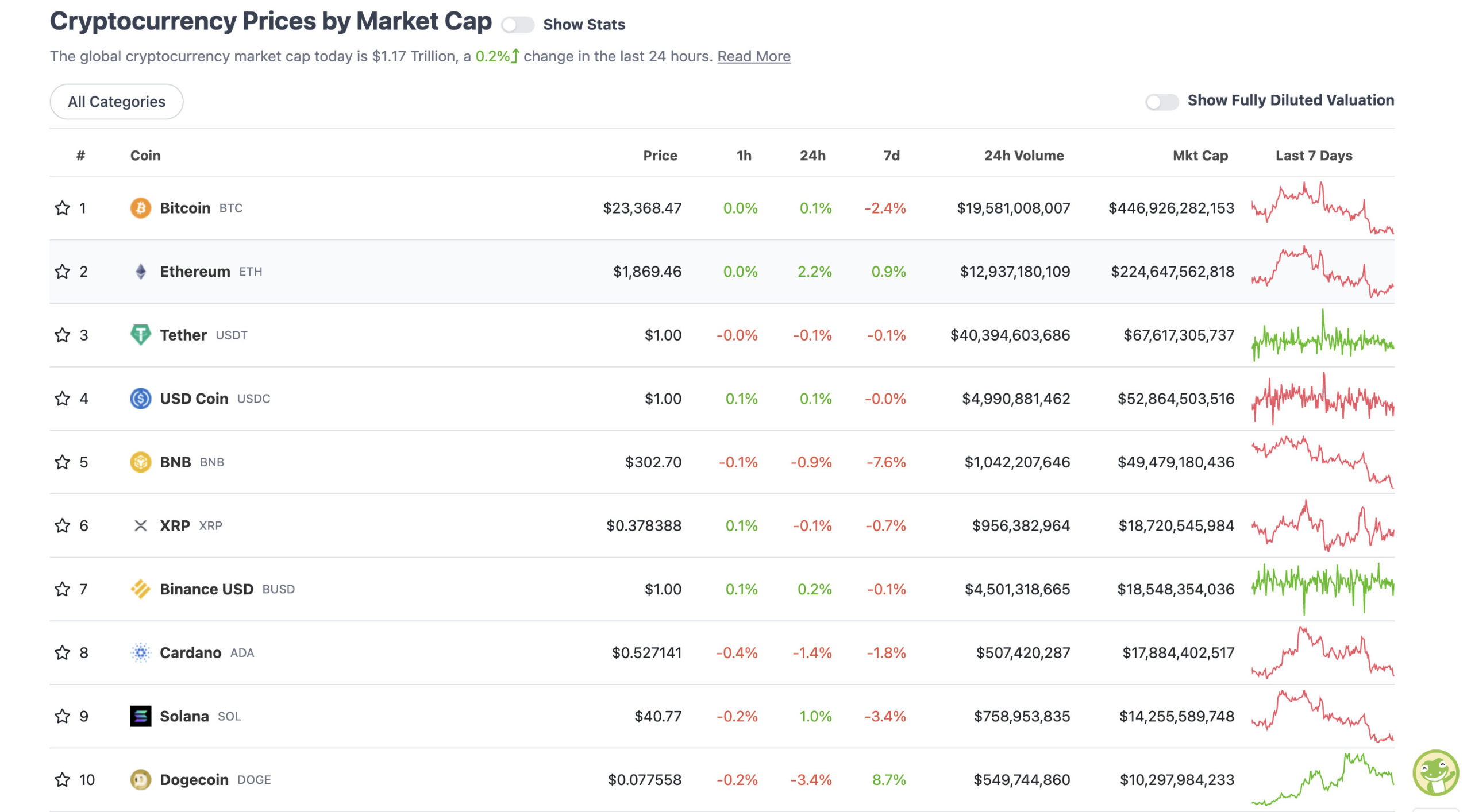

With the general crypto market cap at US$1.17 trillion and up about 0.2% since yesterday, right here’s the present state of play amongst high 10 tokens – in accordance with CoinGecko.

Flat Metropolis within the majors over the previous 24 hours, largely. At the least Ethereum (ETH) has been capable of protect a few of final week’s beneficial properties, although. Nicely, a fraction – 0.9%, which is best than most, significantly BNB and SOL.

Dogecoin (DOGE), after all nonetheless has a hefty remnant of its recent, slobberingly good few days, which might largely be attributed to pleasure based mostly round its transfer into the world of smart-contract functions, with Dogechain. And that’s a sort of layer 2, Ethereum-compatible community for DeFi, NFTs, blockchain video games, you title it, all enabling DOGE as a crypto, or no less than an ETH-wrapped model of it.

Uppers and downers: 11–100

Sweeping a market-cap vary of about US$9.26 billion to about US$455 million in the remainder of the highest 100, let’s discover a number of the greatest 24-hour gainers and losers at press time. (Stats correct at time of publishing, based mostly on CoinGecko.com knowledge.)

DAILY PUMPERS

• Gnosis (GNO), (market cap: US$513 million) +14%

• Evmos (EVMOS), (mc: US$517 million) +2%

• Celsius (CEL), (mc: US$1.2 billion) +2%

• Lido Staked Ether (STETH), (mc: US$7.7 billion) +1%

• LEO Token (LEO), (mc: US$4.95 billion) +1%

DAILY SLUMPERS

• Lido DAO (LDO), (market cap: US$1.26 billion) -9%

• Shiba Inu (SHIB), (mc: US$8 billion) -8%

• Filecoin (FIL), (mc: US$1.96 billion) -8%

• Helium (HNT), (mc: US$888 million) -6%

• Synthetix Community (SNX), (mc: US$766 million) -6%

Across the blocks: Aptos alternative

A number of randomness and pertinence that caught with us on our morning strikes by way of the Crypto Twitterverse…

Some extra airdrop/free crypto “alpha” from the wonderful Olimpio account. Right here, he particulars find out how to probably obtain some $APTOS, which is seemingly the token for a brand new layer 1 blockchain referred to as… Aptos.

Aptos is presently on testnet. Versus mainnet, it signifies that it has not totally launched but.

You may set up a pockets and work together with the testnet blockchain, however cash/tokens are usually not actual.

In case you are unfamiliar with Aptos, here is a thread I madehttps://t.co/Wwj824Jw76

— olimpio ⚡️ (@OlimpioCrypto) August 18, 2022

In the meantime, again on Bitcoin and headwinds and so forth, as soon as once more, right here’s “Roman Buying and selling” analysing the bearish ascending wedge sample BTC finds itself in. He’s concentrating on an 18k-19k USD dip… and a possible bounce from there.

$BTC H4

Profitable breakdown and retest of our ascending wedge. Quantity was first rate on the breakdown which provides affirmation.

If our bearish divergences play out, we must always see a transfer to the 18-19k space. I might search for longs there.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/QdiuuWbKTT

— Roman (@Roman_Trading) August 18, 2022

Hmm, but extra bearish alerts…

#bitcoin misplaced RSI uptrend, bearish MACD cross, dropping 50 day EMA proper now… pic.twitter.com/fdsfB2ykPQ

— Lark Davis (@TheCryptoLark) August 18, 2022

Nonetheless, there was this constructive story yesterday, which is now making world crypto headlines, and you’ll learn a bit extra about it on Stockhead here…

💥BREAKING: Australian comfort retailer chain with +170 areas now accepts #Bitcoin

Full implementation took simply 8 weeks! 🚀 pic.twitter.com/Kg0oQDqpHR

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) August 18, 2022

[ad_2]

Source link