[ad_1]

Andres Victorero

Funding Thesis

Regardless of the current bear market, the Ethereum (ETH-USD) community has expanded and not too long ago responded to the announcement of the Ethereum merger. When it comes to community profitability, ETH is operating into a big resistance within the vary of $1800 and $2400. Once they hit break-even, holders who’re dropping will in all probability divide their pack to cowl their positions.

The Adoption In direction of Ethereum 2.0

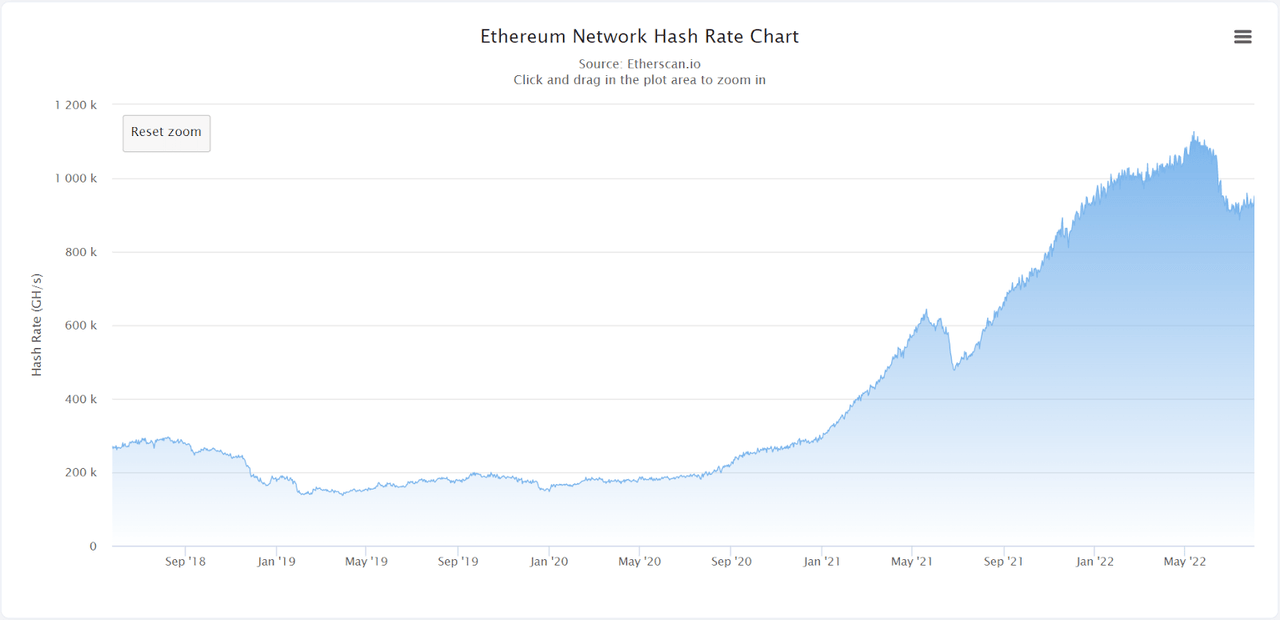

The present drop in Ethereum hash charge earlier than the merge into the POS chain itself wasn’t a nasty factor as a result of mining ETH could possibly be an idea of the previous when Ethereum upgraded to the POS consensus mechanism. It means that miners might need needed to shut down their tools as a result of they should cowl their common price or attain break-even. Thus far, it doesn’t adversely have an effect on the community safety, though there could also be some dangerous community impact on the value within the brief time period.

Ethereum hash charge has dropped earlier than the merge into the POS consensus. (Etherscan)

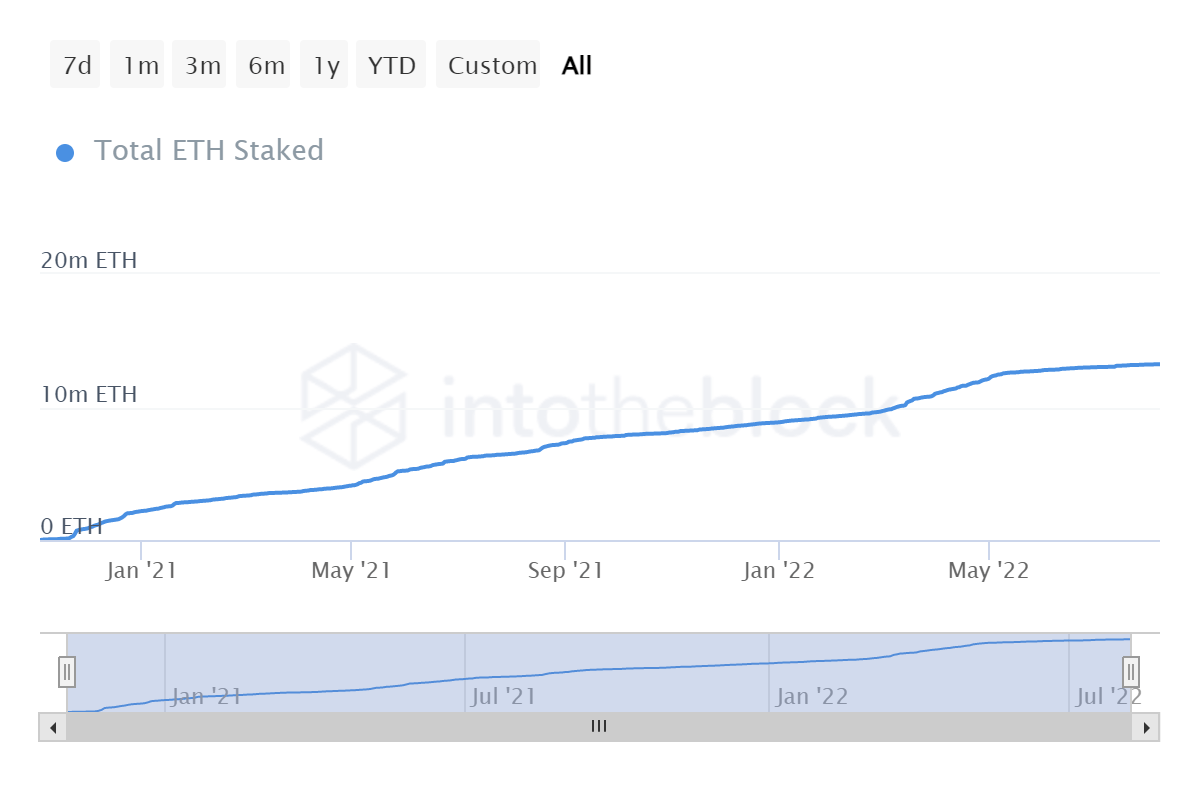

Ethereum 2.0, additionally known as Serenity or ETH 2.0, is an improve of Ethereum by switching from the Proof-of-Work consensus mechanism to the extra superior Proof-of-Stake consensus mechanism. It goals to spice up the transaction capability on the Ethereum community, decrease the transaction charge, and enhance the community’s sustainability. Trying on the whole quantity of ETH staked within the Ethereum 2.0 deposit contract, this information has step by step elevated regardless of the current drop in Ethereum hash charge. It means that stakeholders imagine in the way forward for ETH 2.0 and are making ready for the shift of the community.

The overall quantity of ETH deposited into the staking contract on the Ethereum mainnet has elevated step by step. (IntoTheBlock)

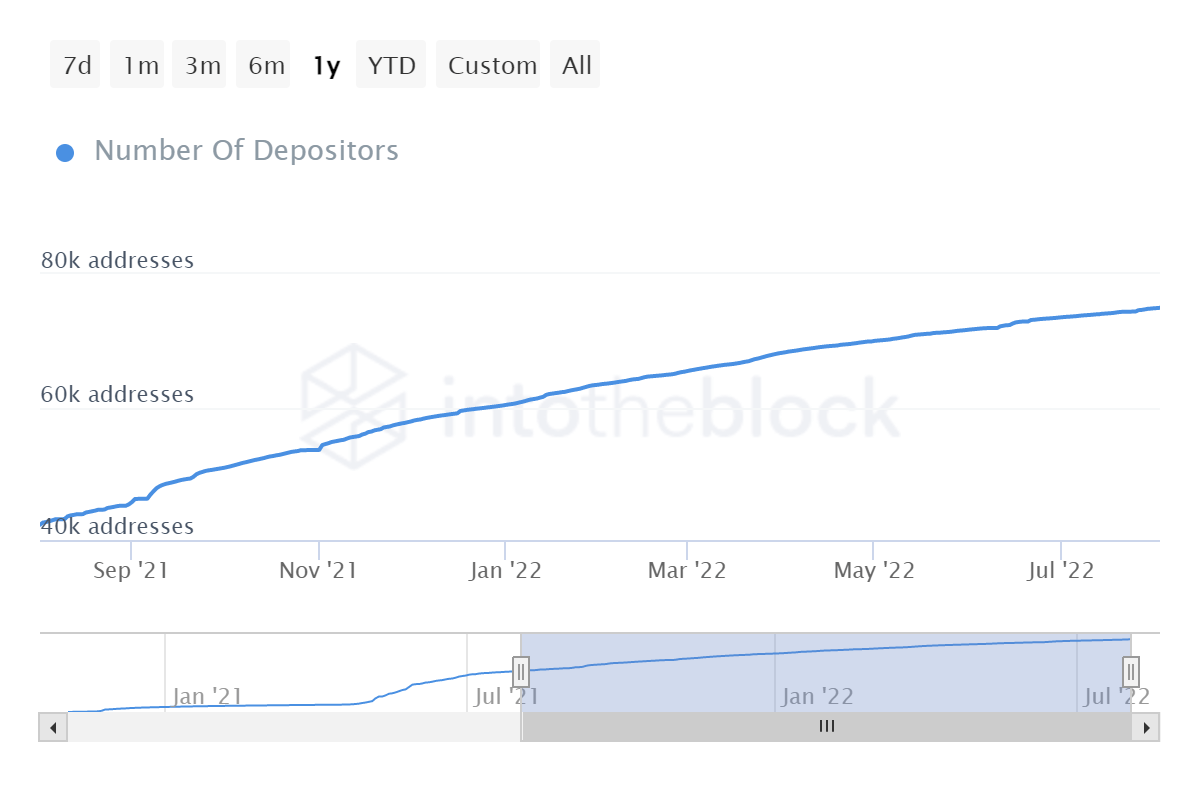

Moreover, the full variety of distinctive addresses depositing ETH to the staking contract has continuously risen together with the quantity of ETH. It offers a greater perception into the adoption of the beacon chain amongst stakeholders when many holders have endorsed the staking swimming pools.

The overall variety of distinctive addresses supplying ETH to the staking contract has step by step elevated. (IntoTheBlock)

Community Progress Is Sturdy

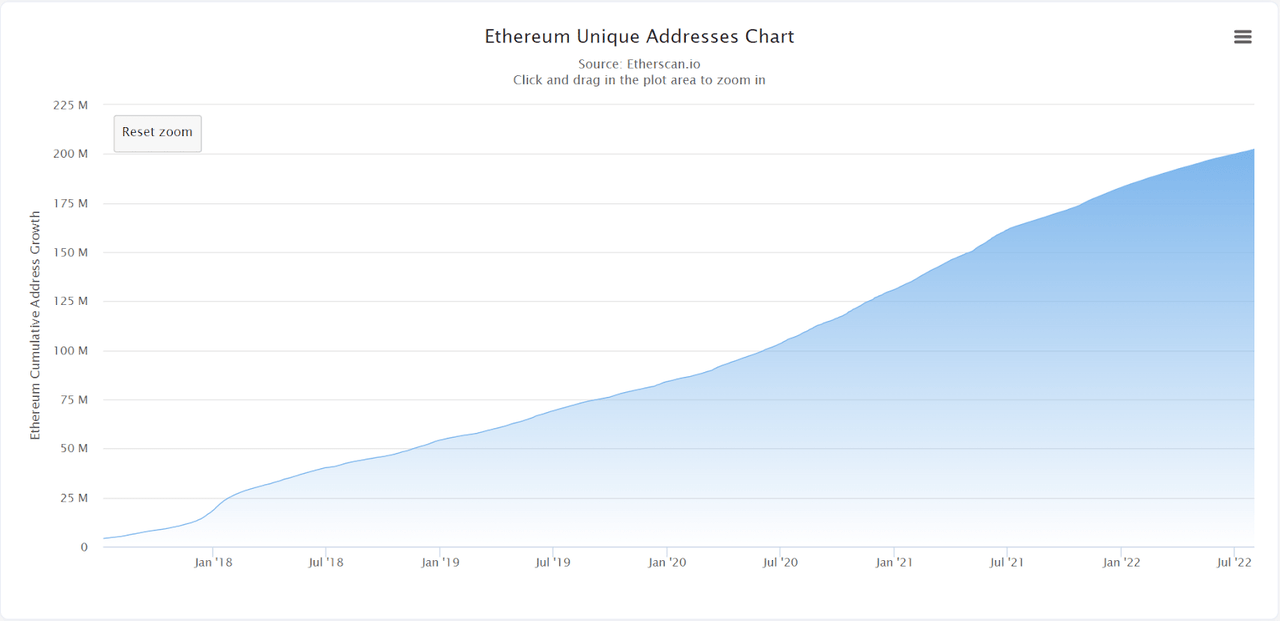

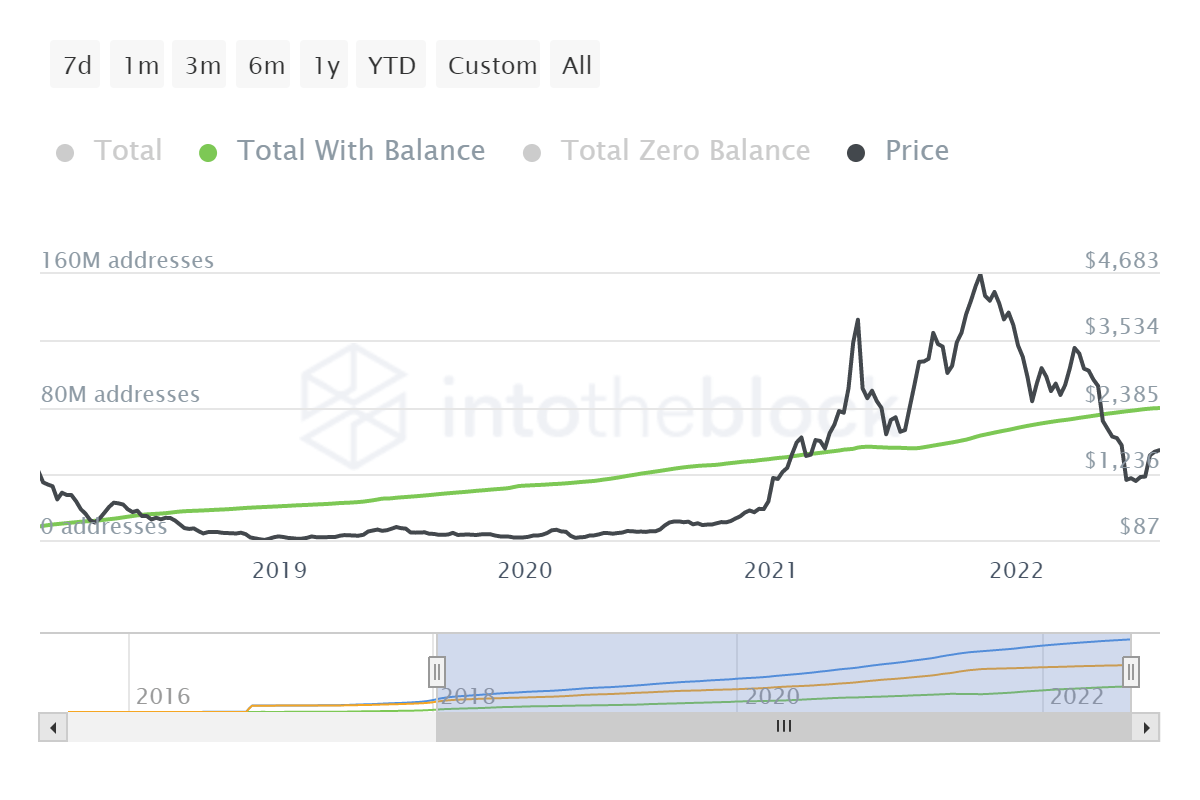

Typically, the variety of distinctive addresses on the Ethereum blockchain has steadily grown since Ethereum’s inception. A sudden upsurge within the variety of distinct addresses could result in short-term volatility within the value motion as merchants are positioning or new customers undertake the community, usually inflicting a consequent rally. As well as, a long-term steadiness throughout all distinctive addresses implies curiosity in holding and investing in Ethereum. When it comes to decentralization, the increasing consumer base and the asset being pretty distributed to its stakeholders could have a constructive impact on the community within the long-term horizon.

The overall variety of distinctive addresses has step by step climbed since Ethereum’s inception. (Etherscan) The overall variety of distinctive addresses with a non-zero steadiness has steadily risen since Ethereum’s inception. (IntoTheBlock)

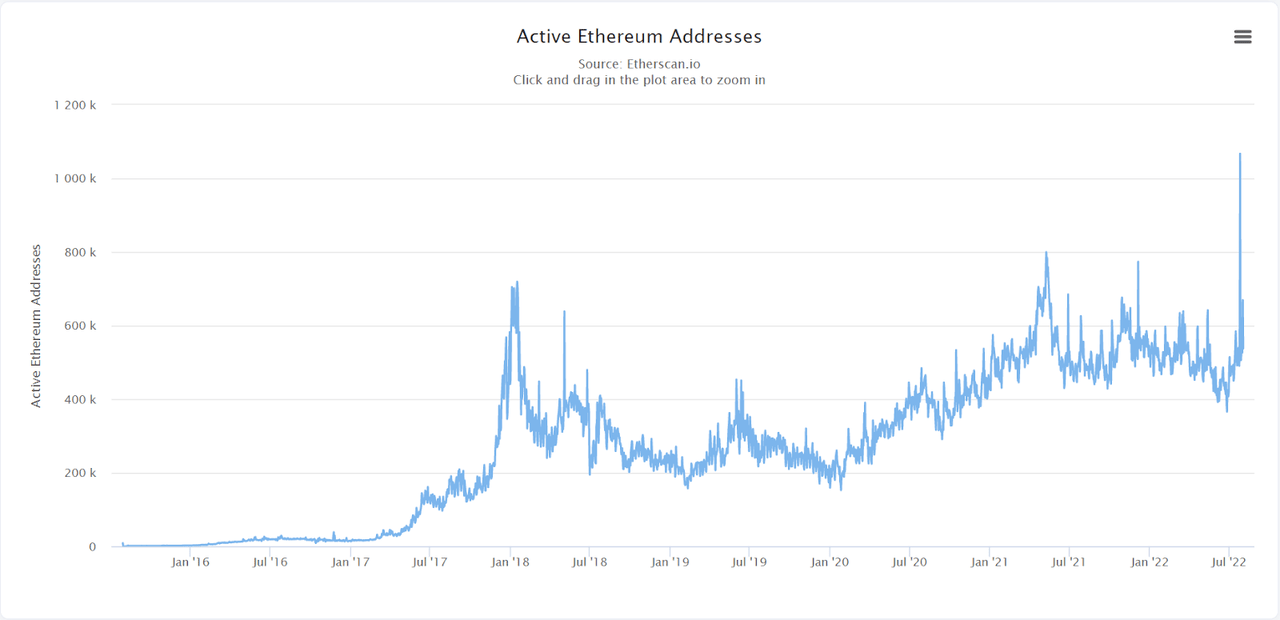

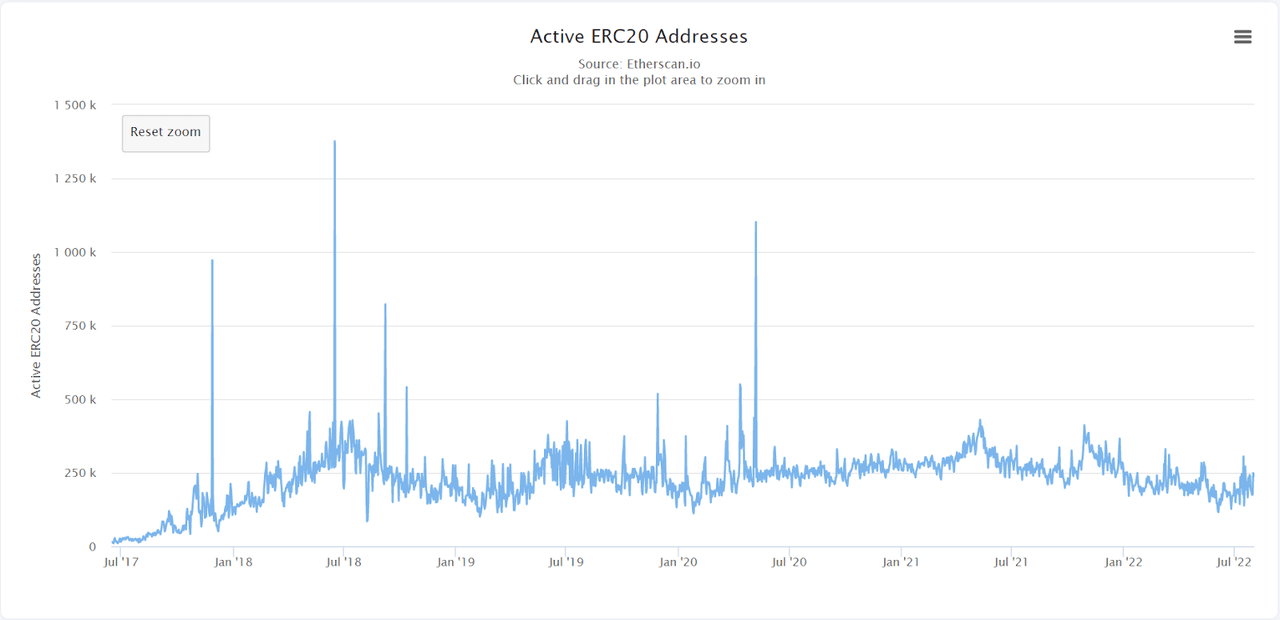

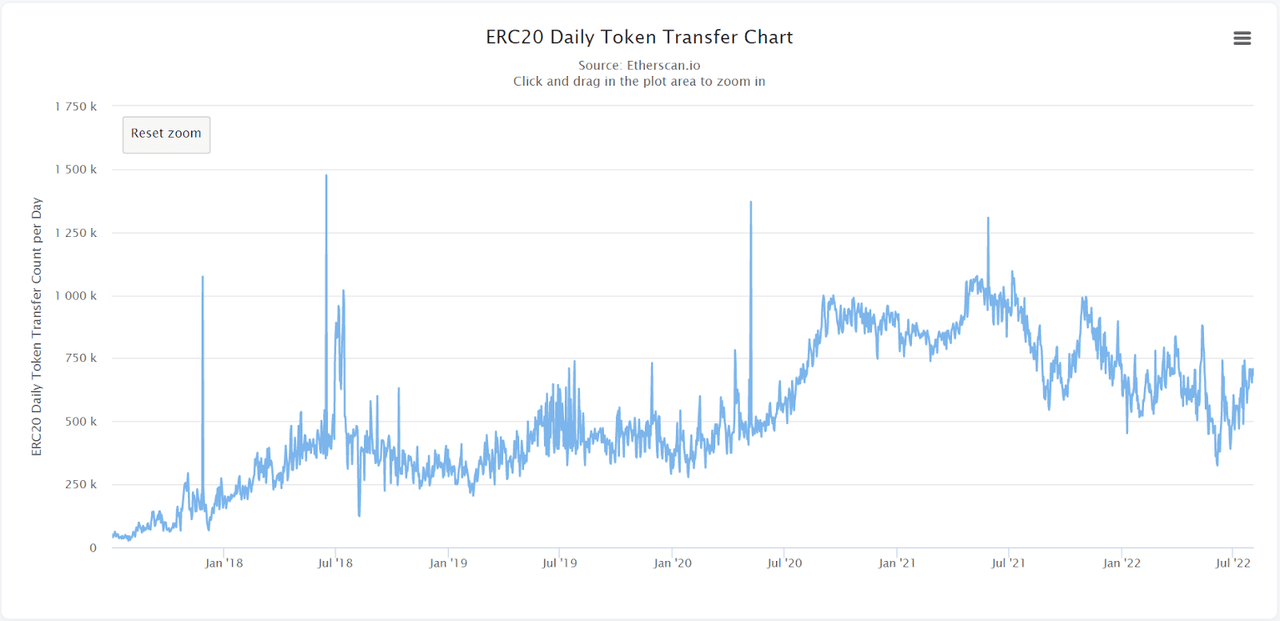

Throughout the present weak market, there was a gradual enhance within the total variety of Ethereum distinctive addresses that have been day by day energetic on the community as a sender or receiver. This quantity has abruptly surged in the course of the previous week, which might have an effect on the value motion as the network effect. Moreover, the full variety of ERC20 distinctive addresses that have been day by day energetic on the community as a ERC20 token sender or receiver has remained secure all through this bear market. It means that the decentralized utilization within the Ethereum ecosystem has maintained and grown.

The variety of Ethereum distinctive energetic addresses has surged. (Etherscan) The variety of ERC20 distinctive energetic addresses has maintained the established order. (Etherscan)

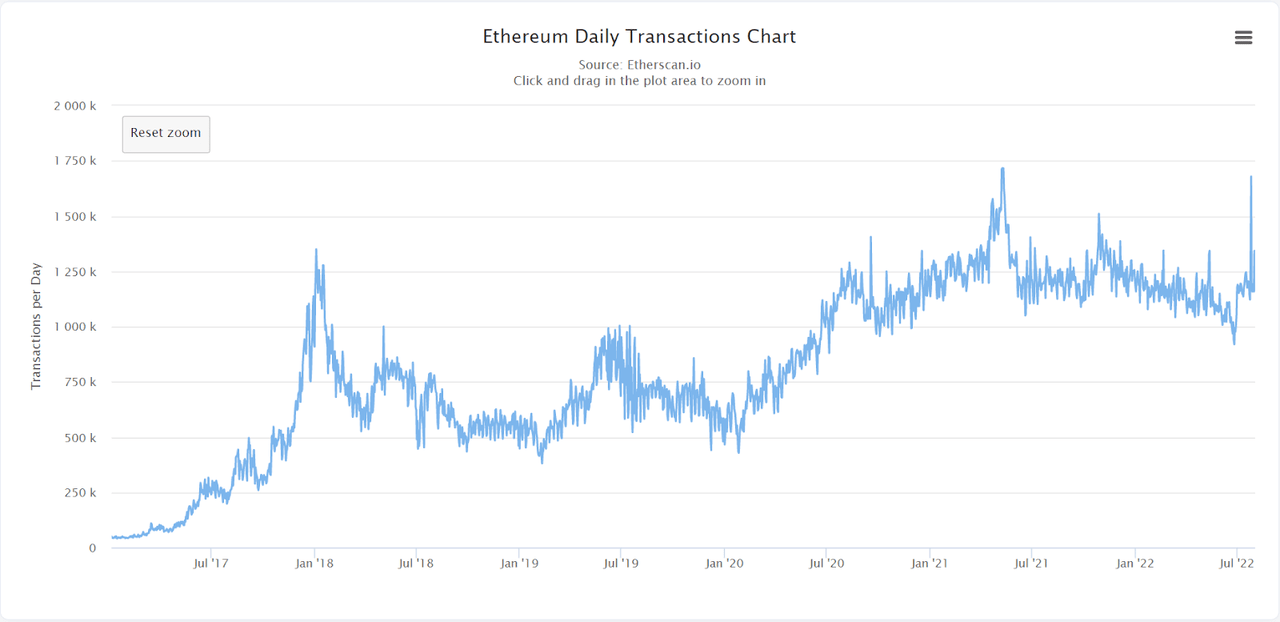

In the meantime, the sum depend of day by day transactions on the Ethereum blockchain was slowly reducing in the course of the bear market together with the variety of ERC20 tokens transferred day by day. Lately, the community is extra energetic when the day by day transaction depend has surged earlier than the Ethereum merge.

The day by day transaction depend has surged earlier than the Ethereum merge. (Etherscan) The variety of ERC20 tokens transferred day by day has not decreased deeply within the bear market. (Etherscan)

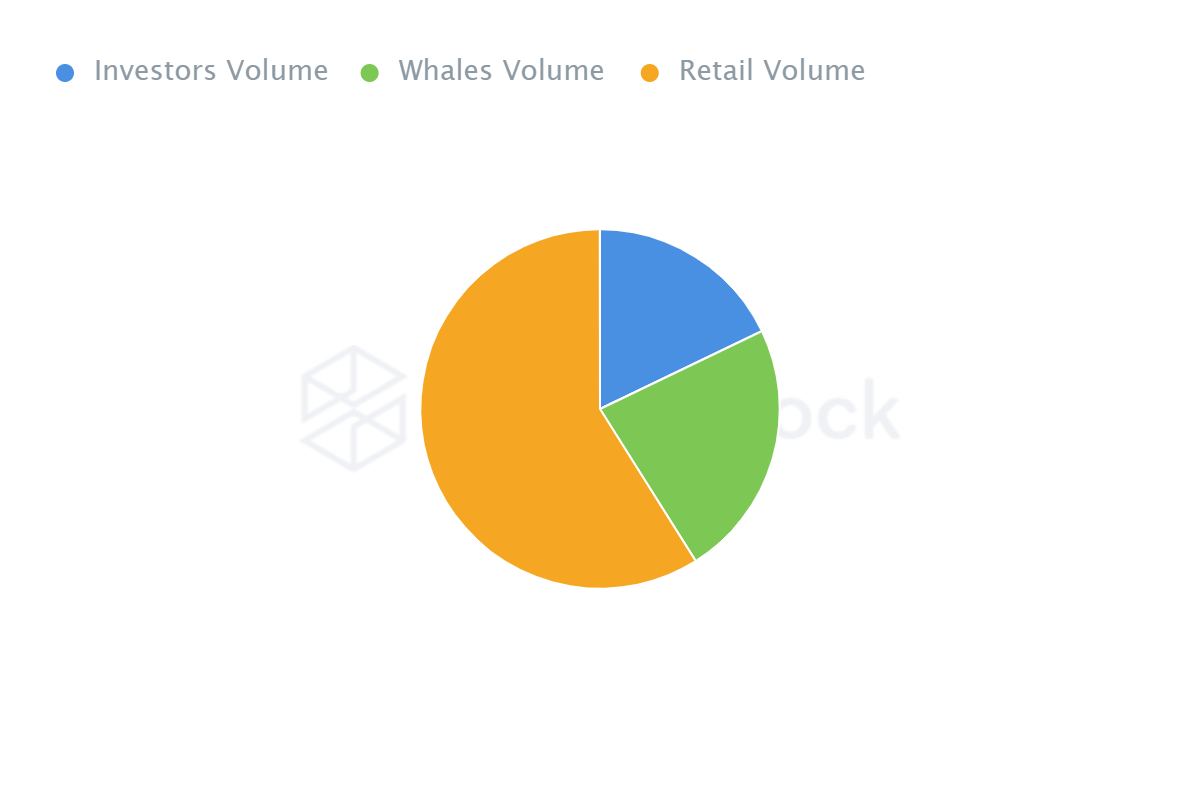

Asset’s Distribution Appears Truthful

As reported by IntoTheBlock, the asset allocation is generally held by retailers with the steadiness of roughly 58.93% of the circulating provide whereas whales and traders maintain the remainder of 23.19% and 17.87%, respectively. It seems good when it comes to decentralization when the asset has been pretty distributed to customers.

The place:

-

Whales are referred to addresses holding over 1% of the circulating provide.

-

Buyers are referred to addresses holding from 0.1% to 1% of the circulating provide.

-

Retails are referred to addresses holding lower than 0.1% of the circulating provide.

Retails maintain 58.93%, Whales maintain 23.19%, Buyers maintain 17.87%. (IntoTheBlock)

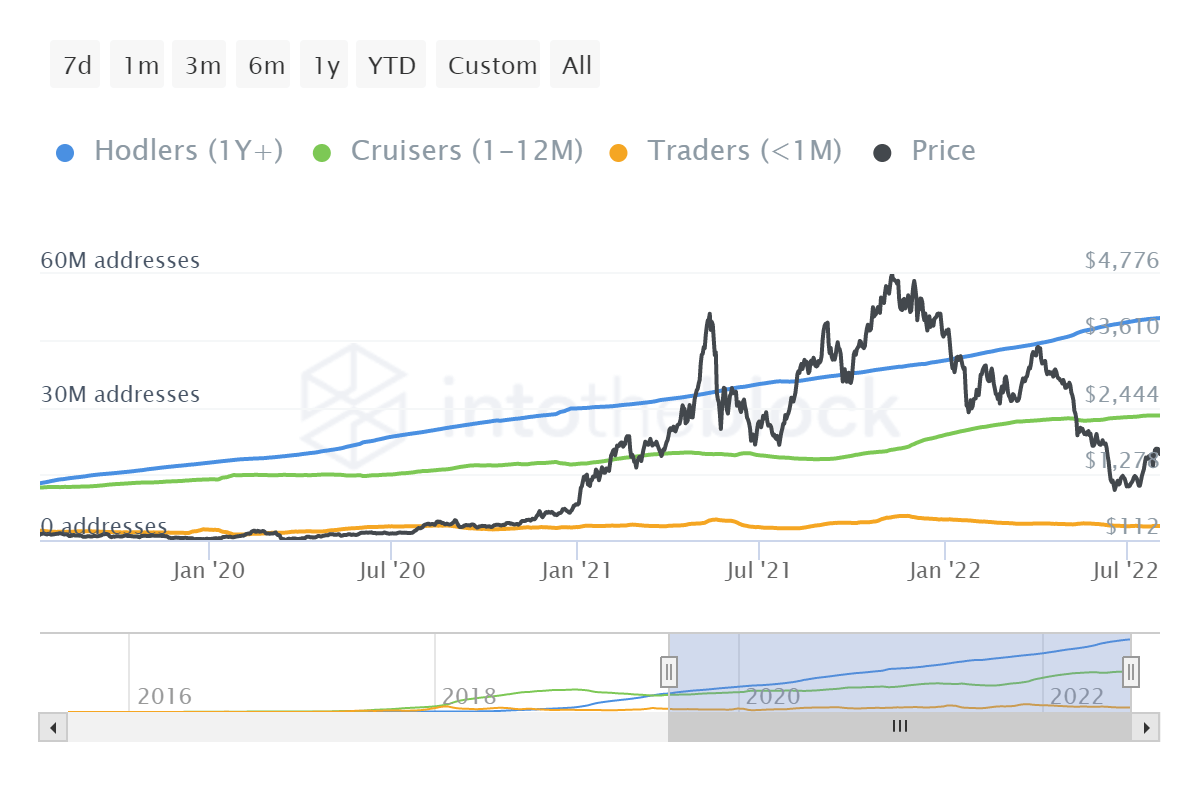

Concerning the asset’s allocation, fewer merchants have been utilizing cash for speculative goals since early 2022. Within the meantime, there was a gradual enhance within the share of holders who maintain their cash for greater than a 12 months and cruisers who maintain their cash for one to 12 months. This can be deduced from the community utility because the digital asset holders search to revenue from their cash by utilizing helpful decentralized functions. It will possibly considerably decrease the unfavourable danger and contribute vastly to the long-term sustainability of the community.

There was a gradual enhance within the proportion of holders and cruisers since early 2022. (IntoTheBlock)

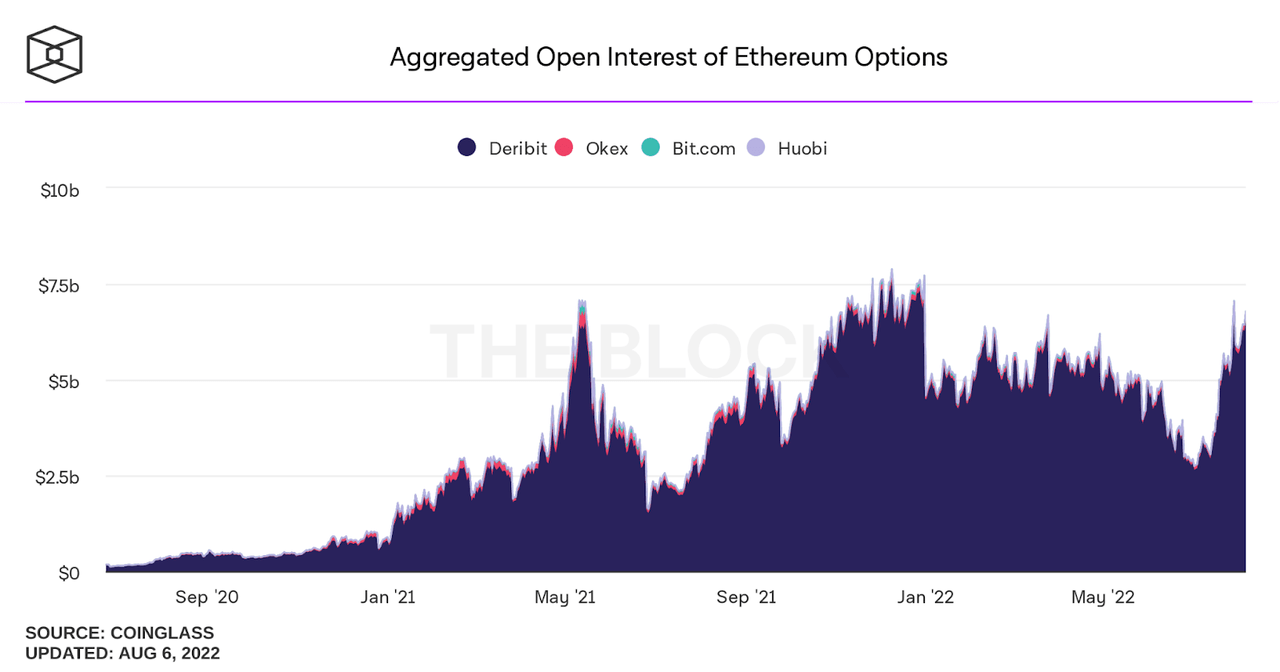

Futures And Choices Markets Are Heating

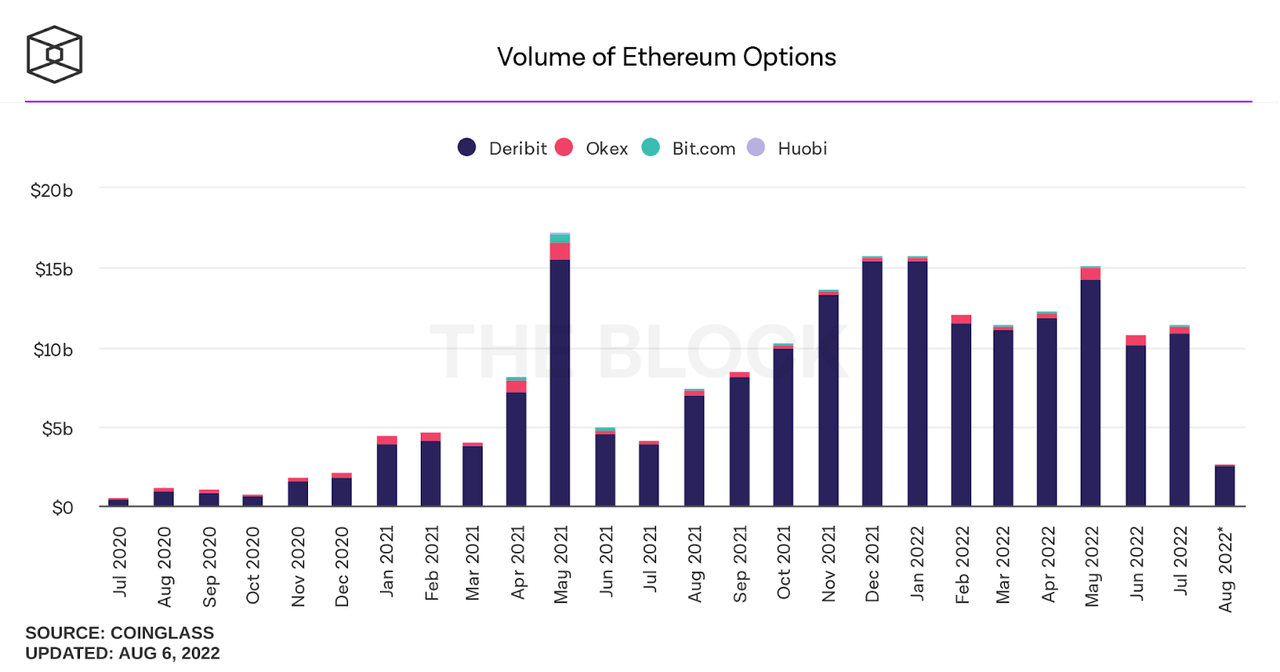

The mixture open curiosity in Ethereum choices throughout all cryptocurrency exchanges has dramatically surged because the current dip. Not solely the depend of contracts, but additionally the combination Ethereum choices buying and selling quantity in greenback phrases throughout the biggest cryptocurrency exchanges. The quantity has remained excessive since early 2022 and is nearly the identical with that in Might and November 2021. This may be assumed from the traders’ expectation aroused by the information of Ethereum merge. Therefore, the market state can get overheated and produce large volatility as may be seen clearly within the peaks of Might 2021 and November 2021, respectively.

The ETH choices market has overheated not too long ago which can trigger volatility. (TheBlock) The mixture Ethereum choices buying and selling quantity in greenback phrases has reached the extent seen in Might and November 2021. (TheBlock)

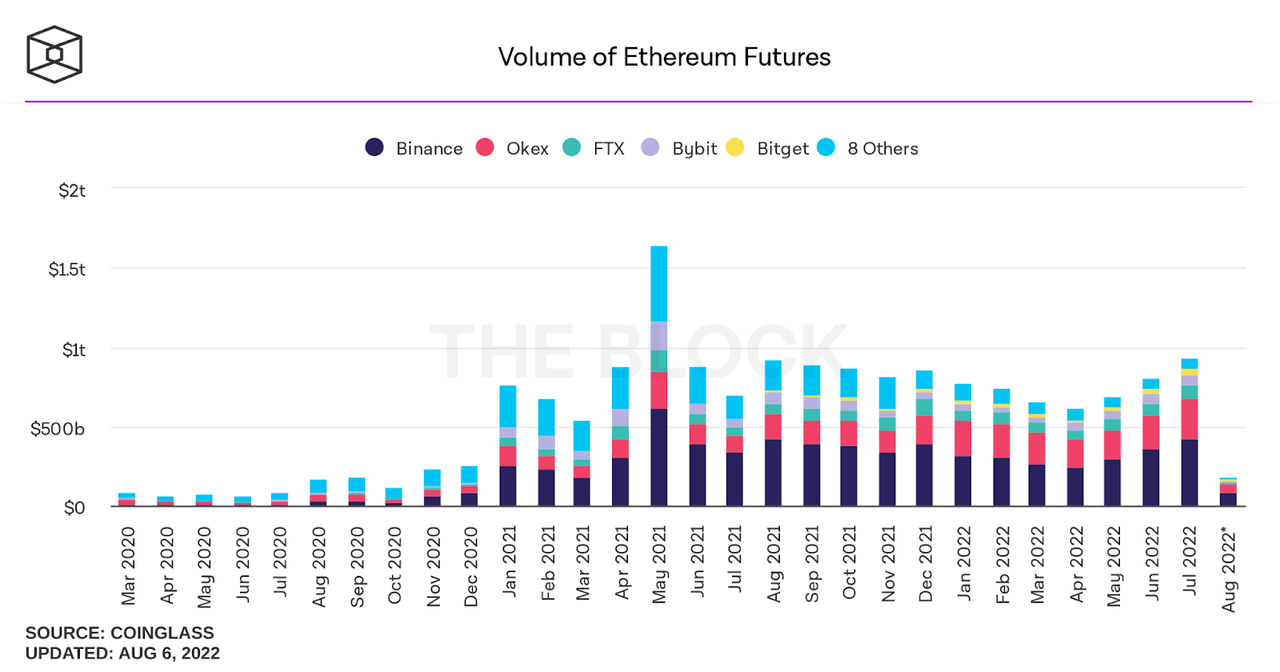

Trying on the combination Ethereum futures buying and selling quantity in greenback phrases throughout the biggest cryptocurrency exchanges, this information has step by step elevated since March 2022, largely from Binance and Okex exchanges. Thus, Ethereum futures merchants are extra energetic throughout this rally.

Ethereum futures merchants are extra energetic throughout this rally. (TheBlock)

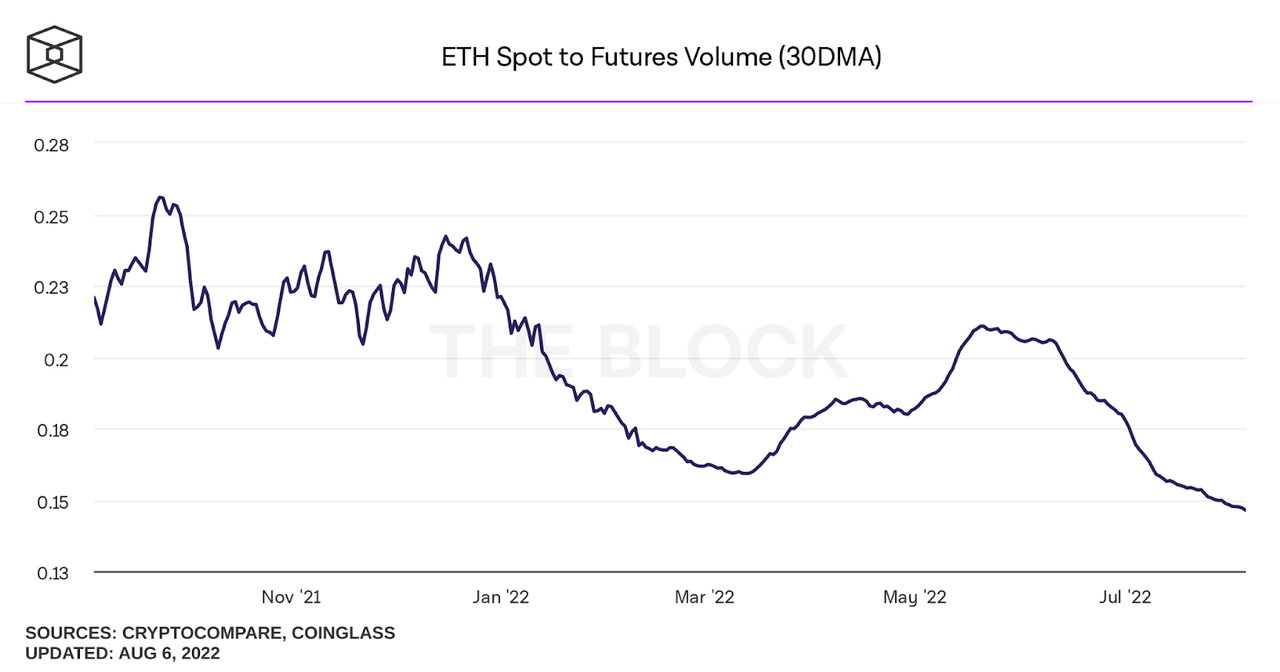

Concerning the ETH spot to futures quantity metric, it’s calculated as the combination day by day ETH spot market quantity divided by the full ETH futures buying and selling quantity. This information has dramatically plummeted whereas ETH’s value has surged not too long ago. It means that this market rally of Ethereum is especially pushed by the futures market. Subsequently, there can be excessive volatility in value motion if open curiosity will get liquidated.

This market rally of Ethereum is especially pushed by the futures market. (TheBlock)

Community Profitability

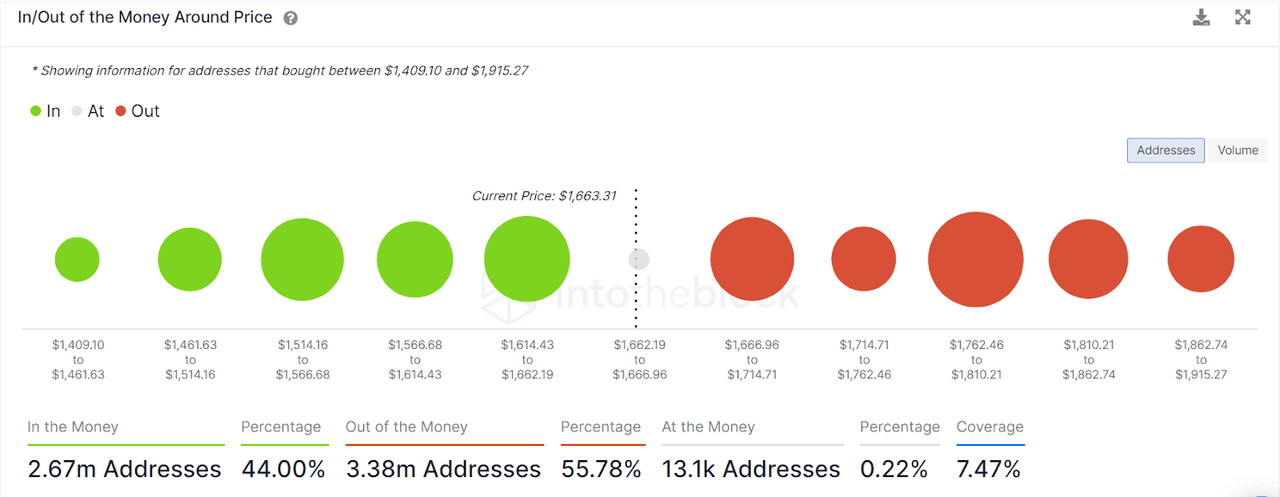

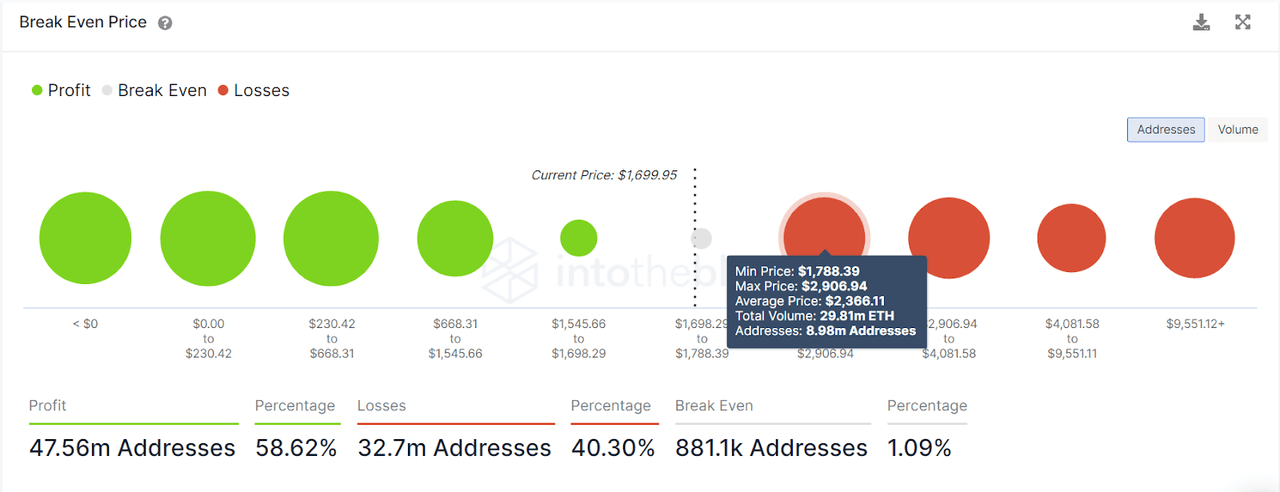

Concerning addresses with a non-zero steadiness, we outline the pockets common price as the typical value at which all tokens within the pockets have been bought. If the present market value is bigger than the pockets common price, the pockets is labeled as “Within the Cash” (or unrealized revenue). If the present market value is lower than the pockets common price, the pockets tackle is labeled as “Out of the Cash” (or unrealized loss). These addresses within the cash at a sure stage of value is illustrated by a inexperienced cluster. These addresses out of the cash at a particular stage of value is illustrated by a purple cluster. This metric affords a complete grasp of the essential ranges of value at which customers should bear losses or income. Because of the tendency of holders to cowl their positions at these value ranges, they’re more likely to act as help or resistance. On this short-term rally, the zone of $1762-$1810 performs because the sturdy resistance for ETH when ETH is transferring upwards from $1000.

The zone of $1762-$1810 is the sturdy resistance for ETH when ETH is transferring upwards from $1000. (IntoTheBlock)

When it comes to realized revenue and loss, an tackle has realized loss when it sells on the present market value that’s decrease than its pockets common price. Conversely, an tackle has realized revenue when it sells on the present market value that’s greater than its pockets common price. Inexperienced clusters account for these addresses which have realized revenue, whereas purple clusters are attributed to addresses which have realized loss. On this case, there are 8.98 million addresses that want ETH to surge to about $1800 to succeed in break-even. At this value, holders are more likely to cowl their place and common price to succeed in break-even. Subsequently, this stage as soon as once more performs because the sturdy resistance for ETH within the short-term value motion.

The value of $1800 performs because the sturdy resistance for ETH within the short-term value motion. (IntoTheBlock)

The Backside Line

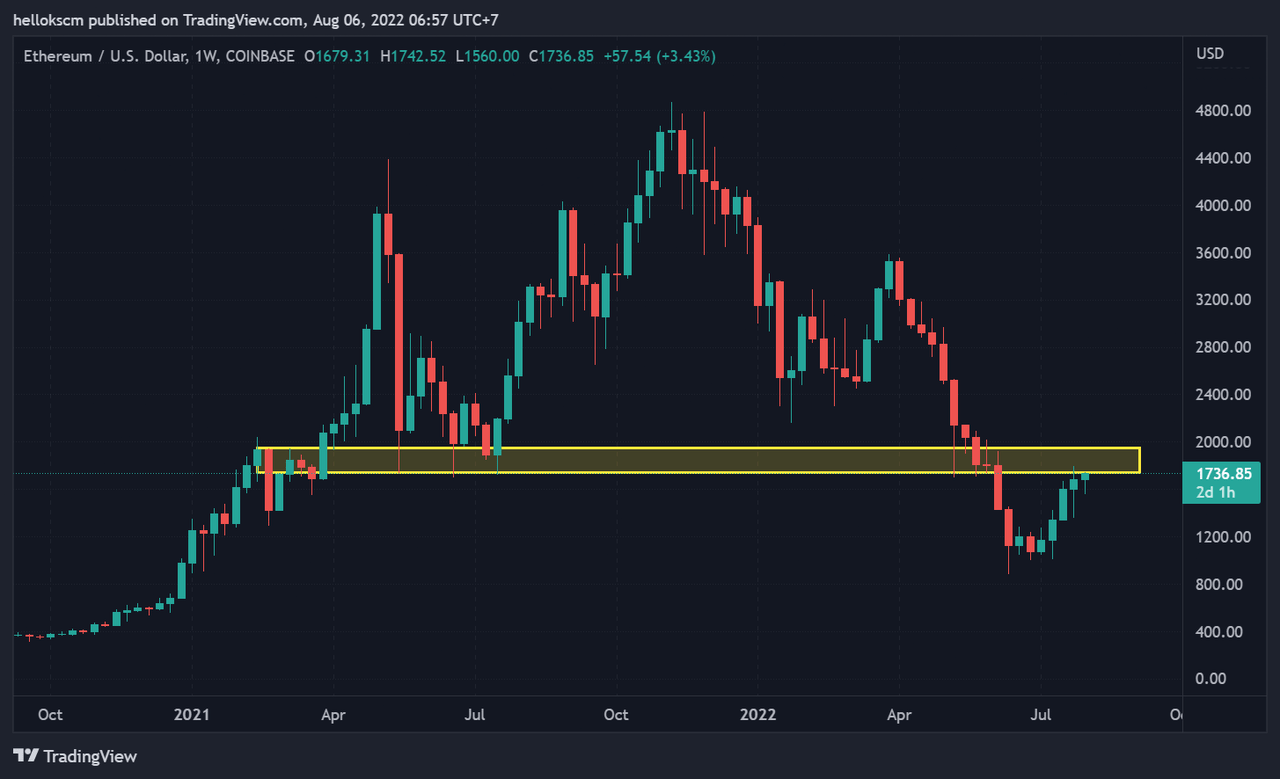

Ethereum’s value motion, the zone of from $1800 to $2400 is a robust resistance for ETH within the subsequent doable short-term bear run. The value is more likely to react to this stage and transfer downwards amid the information of Ethereum merger.

The zone of from $1800 to $2000 is a robust resistance for ETH within the subsequent doable short-term bear run. (TradingView)

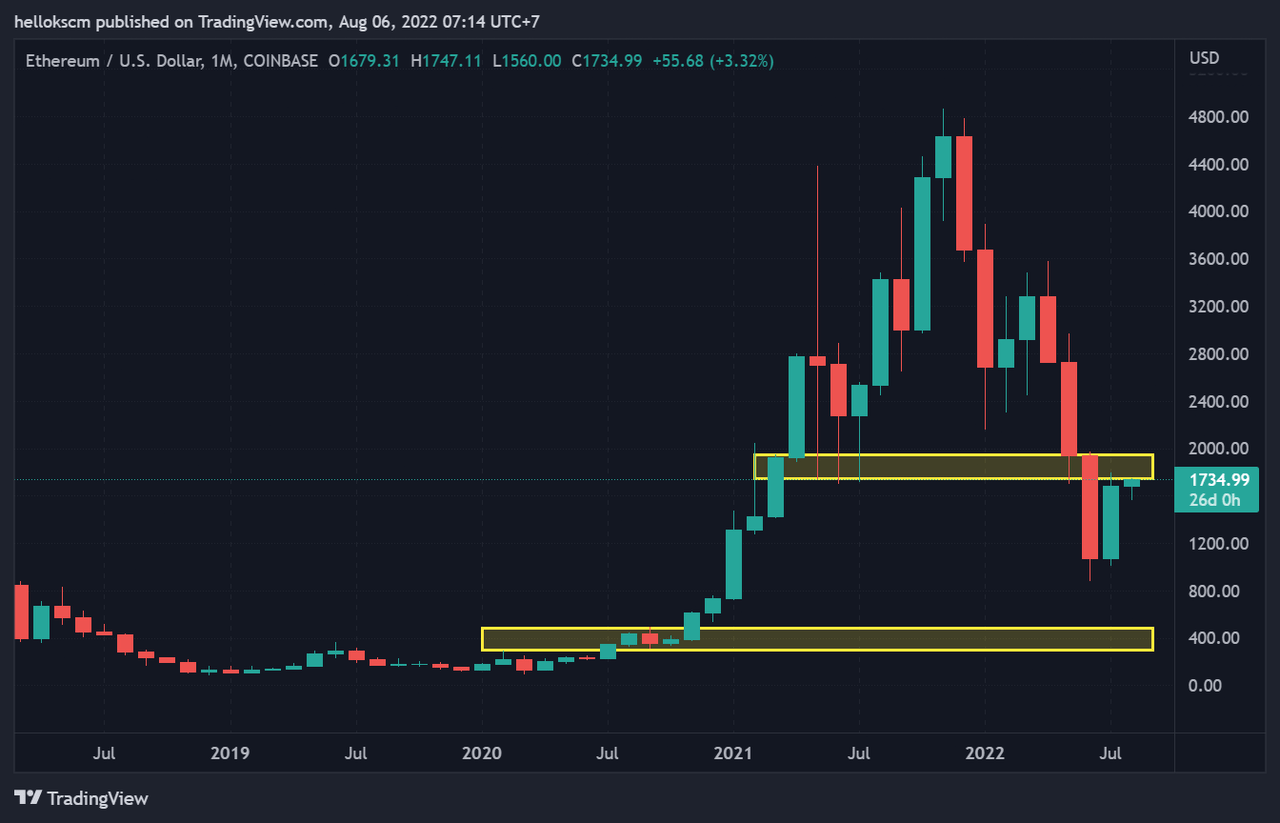

In in search of the subsequent possible backside, we are able to see that the zone between $250 and $450 is the sturdy help for ETH which will be the base for the subsequent rally. Thus, the subsequent accumulation part could start inside this vary of value, and this can be the nice entry space for the subsequent bull market.

The zone between $250 and $450 is the sturdy help for ETH which will be the base for the subsequent rally. (TradingView)

In conclusion, the Ethereum community has grown regardless of the present bear market and not too long ago reacted to the information of the Ethereum merger. Concerning the community profitability, ETH is encountering a robust resistance on the zone between $1800 and $2400. Holders in loss are more likely to divide their pack to cowl their positions when reaching the break-even. It must be a sound technique to hedge in opposition to the draw back danger when the promoting strain is intense close to the resistance. Particularly, the realm of $250 – $450 could possibly be an optimum entry zone to step by step accumulate extra cash earlier than the subsequent rally.

[ad_2]

Source link