[ad_1]

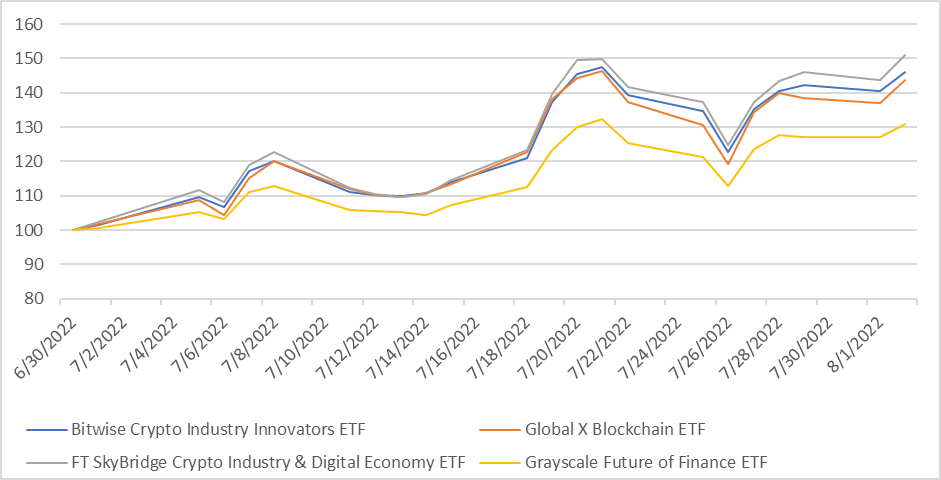

The third-quarter has finished a reasonably good job thus far of debunking the Outdated Wall Avenue recommendation to “promote in Might and go away,” as anybody doing so would have locked in some hefty losses and missed a really wholesome begin to the present quarter. Whereas most the 12 months was dominated by power names, there is a new boss on the block, and by block, I imply to say blockchain.

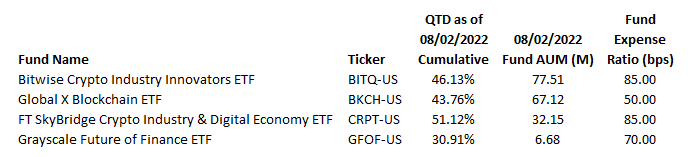

Of the top-25 performing non-leveraged exchange-traded funds thus far this quarter, all however 5 are crypto- or blockchain-focused. Returns vary from ProShares Bitcoin Technique ETF (BITO) , rising 25.2% to the quarter-to-date, to prime canine, First Trust Skybridge Crypto Industry & Digital Economy ETF (CRPT) and its 51.12% achieve.

However funds that sound like they supply the identical or comparable exposures will usually produce completely different outcomes for traders and this can be a nice instance. So, I pulled 4 funds from this record and ran some attribution, so we will get a greater understanding of what drove returns for every product.

The Funds

The opposite top-gaining funds are the Bitwise Crypto Industry Innovators ETF (BITQ) (with 46.13% features), the Global X Blockchain ETF (BKCH) (43.76%), and Grayscale Future of Finance ETF (GFOF) (30.91%).

CRPT is the one actively managed portfolio of the bunch. Index methodologies for the opposite funds may be discovered by these hyperlinks: BITQ (Bitwise Crypto Innovators 30 Index), BKCH (Solactive Blockchain Index), and GFOF (Bloomberg Grayscale Future of Finance Index). From what I can inform, the ETF issuers developed the mental property behind the indexes and have contracts with varied index suppliers for calculation companies, versus the index suppliers creating these indexes and pitching them to the issuers to launch merchandise.

The Bitwise index, nevertheless, is the one one which has choice standards I can get behind, that means that index has set a 75% “Tier 1” threshold for income publicity to crypto-related companies or web asset publicity on to crypto currencies. “Tier 2” names may be decrease, however solely 20% of the index may be weighted in Tier 2 names. The Solactive index tracked by BKCH has the same “Pure Play” and “Diversified” method, however the threshold there may be set at solely 50%. The Bloomberg index tracked by GFOF has a multi-factor eligibility course of, however the income issue additionally classifies exposures above 50% as being “Excessive.” Whereas there isn’t any index methodology for CRPT the prospectus outlines that income publicity larger than 50% in an relevant exercise is sufficient to go muster.

The Outcomes

Earlier than I get into what drove quarter-to-date returns for these funds I am going to point out overlap between them, which is what proportion of holdings are held in widespread throughout all of the funds. Taking a look at CRPT and its 31 holdings, it has 39% overlap with BKCH and GFOF, and 58% overlap with BITQ that means should you personal CRPT it is like having a 58% publicity to BITQ.

One factor that struck me was that in all 4 funds, the underside 10 contributors to efficiency over the interval had been web additive to returns and actually, other than BKCH every fund solely had one title that misplaced floor over the interval together with BITQ: CME Group (CME) (-3.51%), First Belief SkyBridge Crypto Ind and Digi Econ (CRPT) : Meta Platforms (META) (-0.66%); and, GFOF: BC Expertise Group (BCTCF) (-23.71%). The down names in BKCH embody Bigg Digital Property (BBKCF) (-7.64%), Greenbox (GBOX) (-25.54%) and, SOS Ltd. (SOS) (-37.74%).

Within the 40 potential slots that make up the highest 10 contributors to return for these funds there are solely 17 distinctive tickers, and accounting for some funds proudly owning each U.S.- and Canada-listed shares that quantity drops to 14. Of these 14 ,the 5 names that had the largest constructive affect on common throughout all 4 funds are Marathon Digital Holdings (MARA) , Riot Blockchain (RIOT) , Coinbase (COIN) , Silvergate Capital (SI) , and Galaxy Digital Holdings (GLXY) . All 5 names are held in all funds and throughout the board determine into the highest 5 – 6 contributors to return.

Wrap It Up

These outcomes are all spectacular. I like how all of those funds appear to attract contained in the traces of crypto and the crypto trade, though I am not loopy about names like Interactive Brokers (IBRK) , Alphabet (GOOGL) (GOOG) , and Meta exhibiting up on CRPT. Very very similar to one other gold rush from 1849, it looks as if promoting picks and shovels is a greater long-term method than getting publicity to the precise commodity, as evidenced by BITO’s returns quarter-to-date, as in comparison with these funds. If I needed to choose a fund out of those for crypto and crypto trade publicity, I might need to go along with the Bitwise Crypto Business Innovators ETF, if just for the income publicity focus. In case you assume this pattern is prone to carry by the close to to mid-term, then maybe BITQ is price a more in-depth look.

(GOOGL is a holding within the Action Alerts PLUS member membership . Wish to be alerted earlier than AAP buys or sells shares? Be taught more now. )

Get an electronic mail alert every time I write an article for Actual Cash. Click on the “+Observe” subsequent to my byline to this text.

[ad_2]

Source link