[ad_1]

South_agency/E+ by way of Getty Photos

The world of crypto was shaken to its core final week with the entire collapse of TerraUSD (UST-USD), which misplaced primarily 100% of its worth in a number of days’ time. That is however the newest spherical of unfavorable headlines for alt currencies, and mixed with common risk-off preferences from the inventory market in 2022, cryptos themselves, and the miners that generate the cash, have had a tough go of it.

One such miner that has had an especially powerful 2022 is HIVE Blockchain (NASDAQ:HIVE), which has misplaced about two-thirds of its worth simply this 12 months. Nonetheless, on the level the place it has fallen to, HIVE is, weirdly sufficient, a little bit of a price inventory with some crypto-related upside. Let’s have a look.

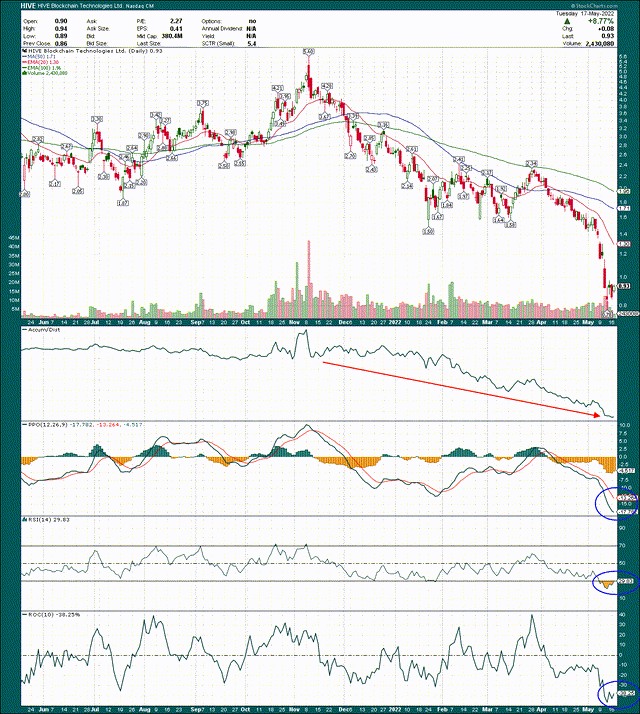

StockCharts

HIVE’s chart is hideous and displays many months of relentless promoting. Crypto miners are typically leveraged performs on the cash themselves, and HIVE is not any totally different. Bitcoin (BTC-USD) and Ethereum (ETH-USD) have been terrible this 12 months, so the miners that mine them have been even worse typically. HIVE matches that description and the chart displays that.

Nonetheless, I feel there’s trigger for optimism, offered you may abdomen the immense volatility that comes with proudly owning a small crypto miner. That’s one thing you need to be okay with earlier than you proceed, as a result of it’s fairly regular for HIVE and different miners to maneuver 10% or extra throughout in the future. In case you’re good with that, let’s check out what HIVE affords right this moment.

HIVE has been utterly dumped this 12 months, as evidenced by its accumulation/distribution line that continues to make new lows. Meaning buyers are promoting rips somewhat than shopping for dips, which is the other habits from what we would like.

On the plus facet, this inventory is unbelievably oversold, with the PPO at -18, and the histogram at -4.5, which signifies super promoting strain. You’ll wrestle to seek out one other asset that has PPO values like this.

The 14-day RSI hit very oversold territory in current days, however is popping increased to point a bounce is underway. And at last, the 10-day fee of change is at -38%, indicating the inventory has misplaced virtually two-fifths of its worth within the span of two weeks. That is the type of volatility you’ll run into with crypto miners, however on this case, I feel it is perhaps useful as a spot to purchase.

Now, if we consider that crypto miners are leveraged performs on the cash themselves, it is sensible to take a look at Bitcoin for HIVE’s evaluation. Let’s dig in.

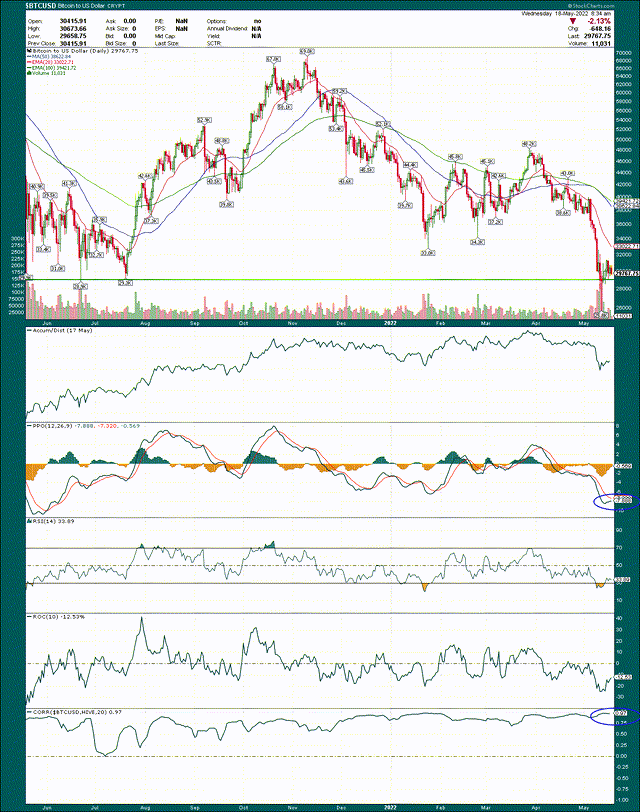

StockCharts

Bitcoin is fairly easy proper now in that the realm round $30k is completely important to carry. We had a quick spike under that final week, nevertheless it was shortly recovered, which is an excellent signal. Nonetheless, we’ve been unable to maneuver any increased than that, so the battle rages on.

Bitcoin, like HIVE, may be very oversold. That will increase the probability of a bounce, however ensures us nothing. I’m nonetheless within the camp that except/till Bitcoin definitively breaks $30k, it’s extra prone to bounce than break down, in order that’s the bottom case I’m working with.

Now, if we have a look at the underside panel within the chart above, now we have the correlation between HIVE and Bitcoin on a 20-day rolling foundation, which is a few month’s value of buying and selling. That correlation is at present 0.97, that means that Bitcoin and HIVE are primarily transferring in lock step with one another. HIVE’s magnitude of strikes is increased, however in essence, you’re getting a leveraged Bitcoin proxy with HIVE primarily based upon this information.

The TL;DR on that is that HIVE is extraordinarily oversold, has an almost good correlation to Bitcoin, and Bitcoin itself continues to carry important assist. Primarily based upon these elements, HIVE appears like an affordable purchase right here.

Now, let’s check out that worth case I discussed earlier.

A crypto worth inventory?

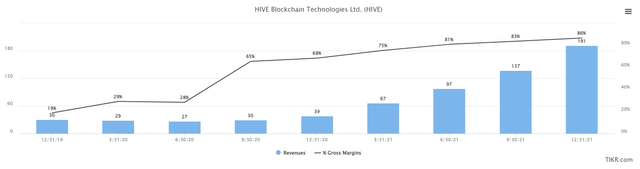

It sounds loopy to even suppose that “worth” and “crypto” could be in the identical sentence, however in HIVE’s case, I’m having a troublesome time not seeing it that method. The corporate has been busy ramping capability in current quarters, as you may see under. We’ve got trailing-twelve-months income in tens of millions in addition to the gross margin produced from that income going again to the top of 2019.

TIKR

Income has ramped increased, and in keeping with estimates, is about to be proper at $200 million yearly for the foreseeable future. If the corporate can preserve its 86% gross margins that might imply annual gross revenue of ~$170 million, from which HIVE would wish to cowl SG&A, D&A, manufacturing prices, curiosity expense, and so forth. For the time being, these prices are fairly small compared to gross margins, with the latest TTM interval coming in at ~28% of income. That signifies that if we take gross margins of 86% and subtract 28% of working prices, we get working margin of 58% of income. That’s excellent, and whereas it strikes round every quarter, you can begin to get a really feel for the profitability of this mannequin, and it’s fairly good.

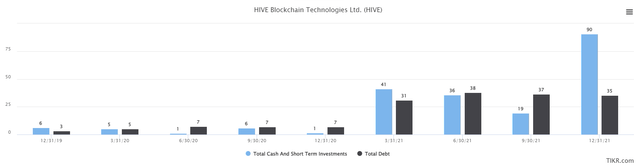

Now, the worth half is available in not solely with sturdy margins, however in HIVE’s case, it’s truly a little bit of a guide worth play. Let’s begin with the stability sheet, with money and equivalents, in addition to complete debt plotted under.

TIKR

HIVE has $35 million in debt, however $90 million in money and equivalents, so its internet debt place is -$55 million, which is excellent. Subsequently, there must be no near-term financing issues as there’s loads of money proper now.

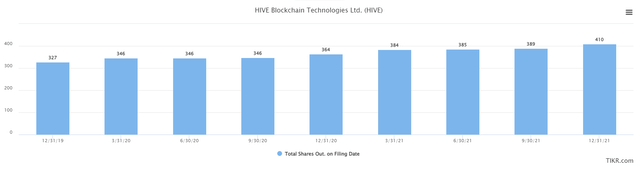

Nonetheless, one motive HIVE has money is as a result of it’s a serial issuer of widespread inventory to finance progress, worker compensation, and acquisitions. The share depend has risen considerably over time, with simply the two-year interval proven under coming in at 25% dilution.

TIKR

That’s so much of dilution, in order that’s one thing you want to concentrate on as nicely for those who’re shopping for this inventory. Administration has no downside doing 100% inventory acquisitions, or issuing shares to workers as compensation, all of which dilutes your stake within the firm. That is an unequivocal damaging for shareholders, so definitely preserve this in thoughts.

Valuing HIVE

Now that we’ve seen the technical evaluation and worth proposition of the enterprise, let’s see how the market is valuing it right this moment. One notice to make is that HIVE is endeavor a 5-for-1 reverse stock split later this week, just because its share worth is under a greenback. That low of a share worth can scale back the pool of consumers for a inventory as a result of some establishments have decrease bounds on the share costs of shares they’re keen to purchase. Reverse inventory splits are all the time completed from a place of weak point, and weak point is one thing HIVE has had loads of this 12 months. Whether or not it really works or to not buoy assist for the inventory stays to be seen, however one thing to bear in mind.

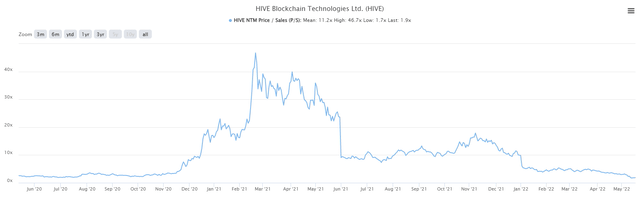

Under now we have the price-to-sales ratio on a ahead foundation for the previous couple of years, which helps us get an thought of how HIVE has been valued by the market.

TIKR

The inventory traded with a low-single digit gross sales a number of previous to the large Bitcoin breakout that occurred in late-2020, after which its P/S ratio hit a stratospheric degree of 47. That’s a ridiculous a number of so don’t anticipate that, however right this moment the inventory trades for simply 1.9X ahead gross sales. That’s a pre-pandemic valuation, however not solely that, HIVE has ramped income and margins increased for the reason that final time it was valued this fashion. In different phrases, the income and margin progress we checked out earlier seem to not be priced in in any respect. It’s as if the market is ignoring all of the progress HIVE has made prior to now two years, and is valuing it like a crypto miner with virtually no income once more. HIVE isn’t that, so it shouldn’t be valued that method.

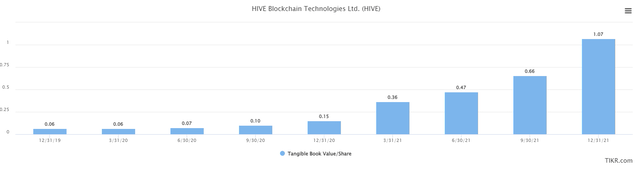

Don’t fancy P/S to worth the inventory? I see the identical type of factor occurring with guide worth as nicely. Under now we have tangible guide worth per share, which I like as a result of it removes intangible belongings with fuzzy valuations and boils the corporate’s worth right down to exhausting belongings with actual market values.

TIKR

The inventory ended the latest quarter with a TBV $1.07 per share, and for those who’re retaining rating at house, that’s 15% increased than the present share worth. Now, both HIVE has burned by way of a bunch of guide worth prior to now couple of months, or, this inventory may be very low-cost. I feel it’s the latter, and primarily based upon the P/S ratio, in addition to sustained excessive ranges of income and margins, I feel the danger on this one is to the upside, not the draw back.

I’ll reiterate once more that investing in crypto miners just isn’t for everybody, so it’s definitely a viable technique to simply cross on this one. HIVE goes to maneuver round so much in each instructions, so for those who’re watching each tick, it might not be the best inventory for you. Nonetheless, I feel there’s the potential for HIVE to see 4X to 6X ahead gross sales once more, which might nonetheless be a low P/S a number of primarily based upon its historic tendencies, however would see the inventory 100% to 200% increased from right here. That type of return would require Bitcoin to carry $30k and transfer meaningfully increased, however that’s my base case for the second. This inventory is simply too low-cost irrespective of the way you have a look at it, except you suppose Bitcoin goes to break down. I don’t, so I’m bullish on this speculative inventory.

[ad_2]

Source link