[ad_1]

Full story: Twitter takeover quickly on maintain, says Elon Musk

Dan Milmo

Elon Musk has mentioned his $44bn takeover of Twitter is “quickly on maintain” after the social media platform claimed that lower than 5% of its customers had been spam or faux accounts.

The Tesla chief tweeted on Friday morning that the deal was being frozen whereas he awaited particulars behind Twitter’s assertion.

Musk introduced the transfer alongside a hyperlink to a Reuters article printed on 2 Could that referred to a filing with the US financial regulator, wherein Twitter claimed that false or spam accounts represented lower than 5% of its day by day common customers.

Twitter deal quickly on maintain pending particulars supporting calculation that spam/faux accounts do certainly symbolize lower than 5% of customershttps://t.co/Y2t0QMuuyn

— Elon Musk (@elonmusk) May 13, 2022

Musk has railed at automated Twitter accounts – which aren’t run manually – and mentioned after saying the takeover that he needed to enhance the platform by “authenticating all people”. He has agreed to pay a $1bn break payment to Twitter if he walks away from the deal.

The information despatched Twitter’s shares down about 23% in pre-market buying and selling, on considerations that the deal might collapse.

Closing Abstract

Time to wrap up.

Elon Musk’s $44bn (£36bn) takeover of Twitter is unsure after he put it “quickly on maintain”, citing considerations over the variety of spam and pretend accounts on the social media platform.

The Tesla chief tweeted on Friday morning that the deal was being frozen whereas he awaited particulars supporting Twitter’s assertion that fewer than 5% of its customers had been spam or faux accounts.

In a subsequent tweet, Musk mentioned he was “nonetheless dedicated to acquisition” – however Twitter’s share worth has nonetheless tumbled round 9% immediately since Wall Road opened.

Twitter’s shares are buying and selling beneath $41 every, roughly a 25% low cost to the $54.20 per share worth Musk agreed to pay in mid-April.

That means buyers don’t imagine a deal will occur wherever close to that worth, and won’t occur in any respect.

Right here’s the total story:

Analysts speculated that the world’s richest man was about to stroll away from the deal or search a cheaper price.

Wedbush Securities analyst Dan Ives was highly critical of Musk’s transfer, saying the tweet despatched the entire deal “right into a circus present”.

As a result of now, the Road’s preliminary response goes to be, ‘he’s on the lookout for a strategy to get out of this deal’.

The newest twist got here on the finish of a uneven week within the markets, which noticed heavy losses amongst tech shares and turmoil within the crypto world.

TerraUSD, the “algorithmic stablecoin” whose collapse prompted a multibillion-dollar selloff throughout crypto markets, has turned off its blockchain and been delisted from main exchanges, in impact shuttering the challenge for good.

Nevertheless, the broader impression of the challenge’s failure seems to have been constrained. TerraUSD was as soon as valued at greater than $40bn (£33bn).

Shockwaves swept through cryptocurrency markets on Thursday as tether, the biggest stablecoin and a foundational a part of the digital asset ecosystem, broke its peg to the greenback. On Friday, nonetheless, tether was again to inside a fraction of a per cent of its $1 peg and has efficiently processed greater than $3bn value of withdrawals with out subject.

Bitcoin can be recovering, up round 8% immediately at round $30,900, however might nonetheless post its worst run of weeky losses on record.

European markets have rebounded, with the FTSE 100 index of blue-chip shares up 172 factors or 2.4% this afternoon.

In New York, the Nasdaq composite index has now jumped 3.3%, as expertise shares recuperate a few of their losses:

“T’was ever thus”

The crash in crypto and speculative tech now rivals web bubble crash (Nasdaq -73% peak-to-trough) & GFC (banks -78%), says BofA.

“Buying and selling sample of post-bubble belongings at all times livid bear rallies amidst lifeless sideways buying and selling vary for couple of years.” pic.twitter.com/N06vzKHlrQ

— Jamie McGeever (@ReutersJamie) May 13, 2022

But US consumer confidence has sunk to its lowest in a decade, as inflation hits America’s households.

Inflation can be inflicting ache within the UK, with warnings that the “golden period” of low-cost meals is coming to an finish….

…though the period of multi-million pound pay packets for prime executives is alive and nicely, with Tesco’s chief government receiving £4.75m:

Have a stunning weekend. GW

Tesla is among the many huge risers on the S&P 500 immediately, with the electrical automobile firm’s inventory leaping virtually 6%.

Twitter is the highest faller, although, down 9% this session.

Tesla’s shares have dropped by 1 / 4 over the past month, as Musk offered a few of his inventory to assist fund the Twitter deal, and used different shares as collateral for a mortgage.

Analyst Michael Hewson of CMC Markets explains:

Twitter shares have fallen sharply after Elon Musk mentioned the takeover deal was on maintain pending particulars supporting the calculation that spam or faux accounts symbolize lower than 5% of whole accounts. This seems to be fuelling considerations that Musk could also be making ready the bottom for backing out of the deal, though he’ll take a $1bn hit had been he to take action.

The timing does appear curious given the lengths Musk has gone with respect to placing financing in place, in any case why go to all that hassle securing secondary financing solely to drag the plug on the final minute?

In fact, if Musk feels the deal doesn’t work for him then he should pay a $1bn break clause which can most likely sting a bit, however he’ll most likely view it as an affordable minimize, particularly since Musk made his bid for Twitter, Tesla shares have fallen over 20%. This fall in worth probably cuts his wriggle room in funding the deal from the worth of his Tesla shares.

Tesla shares, alternatively, are on the up, maybe on the prospect {that a} deal has change into much less seemingly, or that the deal worth would possibly get negotiated down.

Elon Musk sowed new chaos into the market today by placing his takeover bid for Twitter on maintain, explains Bloomberg:

However they level out that doubts had already been swirling in regards to the deal:

Doubts have grown in latest days that Musk would be capable to pull off his acquisition of Twitter, and that the entrepreneur might contemplate dropping his bidding worth for the micro-blogging website. The entire transaction has been a frenzied and untraditional affair, largely performed out on Twitter.

Musk went from being “simply” a prolific person to revealing a greater than 9% stake within the firm after which launching an unsolicited takeover supply — with out detailed financing plans — inside a matter of weeks. It all came together at breakneck pace partially as a result of Musk waived the prospect to take a look at Twitter’s funds past what was publicly accessible.

And on Musk’s considerations about spam accounts…the calculation that lower than 5% of accounts are faux has been utilized by Twitter for near a decade.

Bloomberg provides:

The proposed takeover features a $1 billion breakup payment for every celebration, which Musk should pay if he ends the deal or fails to ship the acquisition funding as promised. It’s unclear whether or not an replace by Twitter on the variety of faux accounts — if materially bigger than 5% — would set off a so-called materials opposed impact clause, releasing Musk from the breakup payment.

Some snap response to the slide in US shopper confidence:

Dismal US shopper confidence information – sinks to lowest since Aug 2011, present circumstances index lowest since March 2009.

Again to the outdated ‘dangerous information is nice information’ for danger belongings as markets worth in a much less restrictive Fed? Nasdaq jumps 3%. pic.twitter.com/Ip8yqJywP0

— Jamie McGeever (@ReutersJamie) May 13, 2022

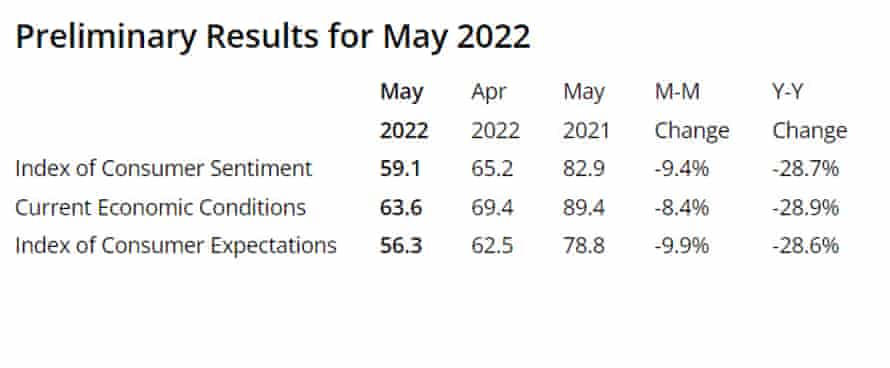

US shopper sentiment weakest since 2011

US shopper confidence has taken one other hefty knock this month, as inflation hits households.

The College of Michigan’s index of shopper sentiment has declined by 9.4% from April, reversing final month’s features, to hit its lowest since 2011.

It dropped to simply 59.1 for this month, in contrast with 82.9 a yr in the past earlier than worth began their steep climb.

The Index of Shopper Sentiment fell from 65.2 in April to 59.1 in Could, the bottom studying since August 2011, in response to preliminary information from the College of Michigan and Thomson Reuters. pic.twitter.com/PG59WfYW1k

— Chad Moutray (@chadmoutray) May 13, 2022

The report says individuals haven’t been this downbeat on their monetary state of affairs in virtually a decade, with inflation hitting confidence.

These declines had been broad based–for present financial circumstances in addition to shopper expectations, and visual throughout earnings, age, training, geography, and political affiliation–continuing the overall downward pattern in sentiment over the previous yr.

Shoppers’ evaluation of their present monetary state of affairs relative to a yr in the past is at its lowest studying since 2013, with 36% of customers attributing their unfavourable evaluation to inflation. Shopping for circumstances for durables reached its lowest studying because the query started showing on the month-to-month surveys in 1978, once more primarily as a result of excessive costs.

Twitter shares slide 10%

Shares in Twitter have tumbled 10% in early buying and selling.

They’ve dropped to $40.32, from $45 final evening, on considerations that Elon Musk will stroll away from the takeover, or try to renegotiate the worth.

That widens the unfold to Musk’s agreed supply of $54.20 — which exhibits a higher likelihood that it received’t occur, at the very least at that worth:

$TWTR down 11.25% — with that in thoughts, The unfold, a delicate indication of how a lot Wall Road believes the takeover will likely be accomplished, has blown out to $13.80 on the open, the widest since deal announcement @elonmusk pic.twitter.com/MzZBLFs7B2

— Ed Ludlow (@EdLudlow) May 13, 2022

Wall Road has opened larger, on the ultimate session of a turbulent week wherein worries about slowing development and rising rates of interest hit shares.

The S&P 500 index has jumped 1.4%, or 55 factors, to three,985 factors, pulling away from bear market territory.

Shopper discretionary shares, expertise and vitality are the highest performing sectors.

Away from the Twitter deal, new financial institution lending in China has hit the weakest in practically 4 and half years in April.

It suggests demand for credit score from companies and households weakened as new Covid-19 lockdowns had been introduced, weakening the economic system.

Chinese language banks prolonged 645.4 billion yuan ($95.14 billion) in new yuan loans in April, down about 80% from March and dipping to the bottom stage since December 2017, in response to the Individuals’s Financial institution of China information, which missed forecasts.

Chinese language new yuan loans drop sharply through the month of April as credit score demand within the nation considerably weakens. pic.twitter.com/e08TaOf5lm

— Longview Economics (@Lvieweconomics) May 13, 2022

Capital Financials mentioned in a word.

“Lending was a lot weaker than anticipated final month as lockdowns weighed on credit score demand. This could nudge the PBOC to announce additional easing measures quickly.

However the central financial institution continues to sign a comparatively restrained strategy.”

The US inventory markets is ready to rally, after a really turbulent week that noticed tech shares tumble laborious:

U.S. STOCK INDEX FUTURES EXTEND GAINS, NASDAQ FUTURES LAST UP 2%

— First Squawk (@FirstSquawk) May 13, 2022

Twitter’s share worth has recovered some of its earlier losses.

It’s presently down round 11% in pre-market buying and selling, at $40, having dropped as little as $34 when Musk mentioned the deal was on hold, from $45 final evening.

In fact, we’ve now received a good suggestion of what Twitter could be value with out Musk’s $54.20/share bid…

“Nonetheless dedicated to acquisition”

… however simply out of curiosity let’s see the place the inventory would commerce after the latest market selloff if I quickly took my $54.20 supply off the desk. https://t.co/w5kUMkinNJ

— Brian Chappatta (@BChappatta) May 13, 2022

Musk: Nonetheless dedicated to acquisition

Elon Musk has now tweeted that he’s “Nonetheless dedicated” to the acquisition….

Nonetheless dedicated to acquisition

— Elon Musk (@elonmusk) May 13, 2022

Full story: Twitter takeover quickly on maintain, says Elon Musk

Dan Milmo

Elon Musk has mentioned his $44bn takeover of Twitter is “quickly on maintain” after the social media platform claimed that lower than 5% of its customers had been spam or faux accounts.

The Tesla chief tweeted on Friday morning that the deal was being frozen whereas he awaited particulars behind Twitter’s assertion.

Musk introduced the transfer alongside a hyperlink to a Reuters article printed on 2 Could that referred to a filing with the US financial regulator, wherein Twitter claimed that false or spam accounts represented lower than 5% of its day by day common customers.

Twitter deal quickly on maintain pending particulars supporting calculation that spam/faux accounts do certainly symbolize lower than 5% of customershttps://t.co/Y2t0QMuuyn

— Elon Musk (@elonmusk) May 13, 2022

Musk has railed at automated Twitter accounts – which aren’t run manually – and mentioned after saying the takeover that he needed to enhance the platform by “authenticating all people”. He has agreed to pay a $1bn break payment to Twitter if he walks away from the deal.

The information despatched Twitter’s shares down about 23% in pre-market buying and selling, on considerations that the deal might collapse.

[ad_2]

Source link